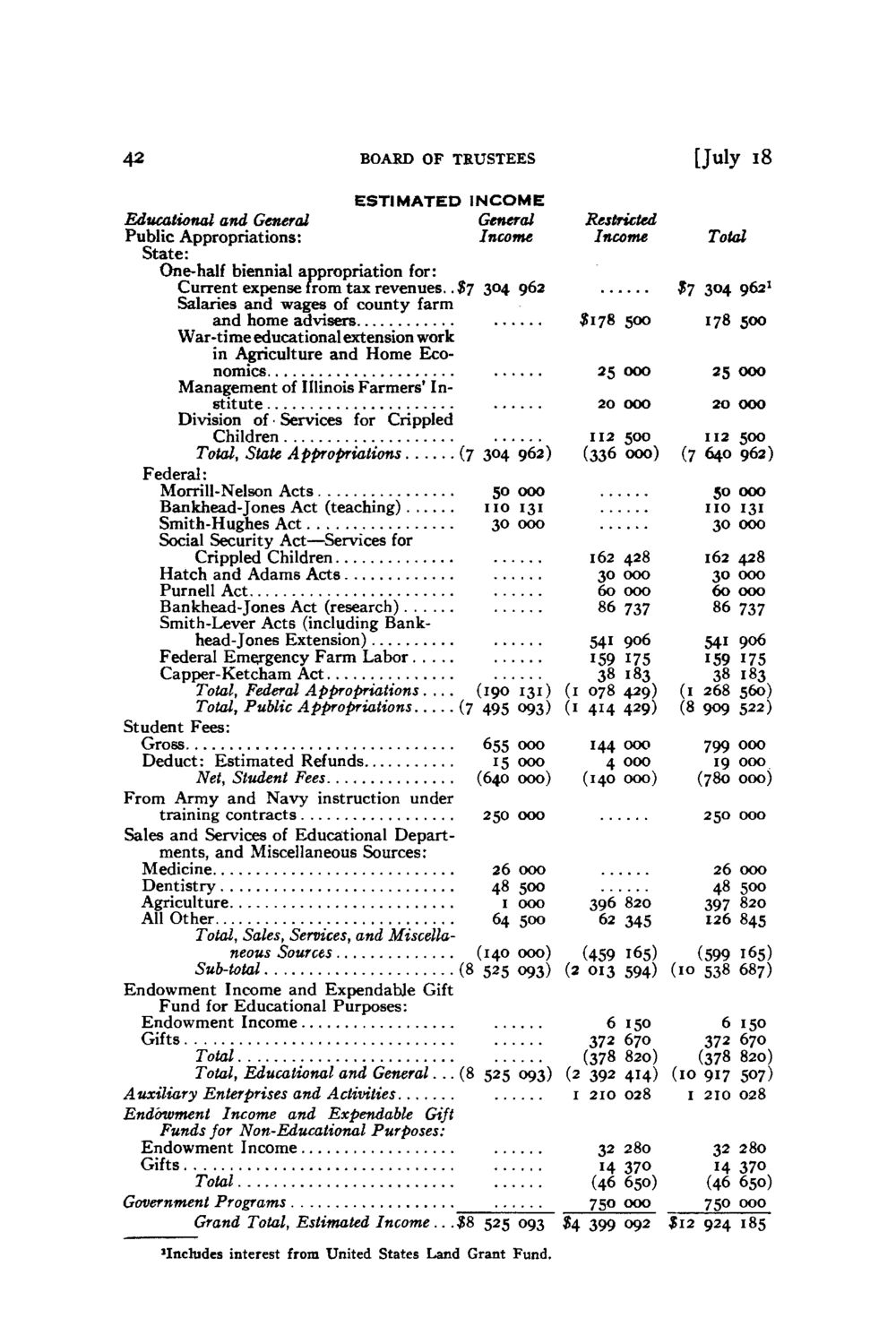

Caption: Board of Trustees Minutes - 1946

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

42 BOARD OF TRUSTEES [July 18 Restricted Income ESTIMATED INCOME Educational and General General Public Appropriations: Income State: One-half biennial appropriation for: Current expense from tax revenues.. $7 304 962 Salaries and wages of county farm and home advisers War-time educational extension work in Agriculture and Home Economics Management of Illinois Farmers' Institute Division of • Services for Crippled Children Total, State Appropriations (7 304 962) Federal: 50 O O O Morrill-Nelson Acts n o 131 Bankhead-Jones Act (teaching) 30 000 Smith-Hughes Act Social Security Act—Services for Crippled Children Hatch and Adams Acts Purnell Act Bankhead-Jones Act (research) Smith-Lever Acts (including Bankhead-Jones Extension) Federal Emergency Farm Labor Capper-Ketcham Act Total, Federal Appropriations . . . . (190 131) Total, Public Appropriations (7 495 093) Student Fees: Gross 655 000 Deduct: Estimated Refunds 15 000 Net, Student Fees (640 000) From Army and Navy instruction under training contracts 250 000 Sales and Services of Educational Departments, and Miscellaneous Sources: 26 000 Medicine Dentistry 48 500 Agriculture I OOO All Other 64 500 Total, Sales, Services, and Miscellaneous Sources (140 0 0 0 ) Sub-total (8 525 0 9 3 ) Endowment Income and Expendable Gift Fund for Educational Purposes: Endowment Income Gifts Total Total, Educational and General... (8 525 093) Auxiliary Enterprises and Activities Endowment Income and Expendable Gift Funds for Non-Educational Purposes: Endowment Income Gifts Total Government Programs Grand Total, Estimated Income. •*8 525 093 'Includes i t r s from United States Land Grant Fund. neet Total $7 3 0 4 9 6 2 1 $ 1 7 8 500 178 5 0 0 25 000 20 OOO 112 5O0 (336 000) 25 000 20 000 112 5O0 (7 64O 962) 50 000 n o 131 30 000 162 30 60 86 541 159 38 (1 078 414 (1 428 000 000 737 906 175 183 429) 429) 162 30 60 86 541 159 38 (1 268 (8 909 428 000 000 737 906 175 183 560) 522) 144 000 4 000 (140 000) 799 000 19 000 (780 000) 250 000 396 820 62 345 26 48 397 126 000 500 820 845 (459 165) (599 165) (2 013 594) (10 538 687) 6 150 6 372 670 372 (378 820) (378 (2 392 414) (10 917 1 210 028 I 210 32 14 (46 750 $4 399 092 S12 924 32 280 14 370 (46 650) 750000 150 670 820) 507) 028 280 370 650) 000 185

|