| |

| |

Caption: Board of Trustees Minutes - 1956

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

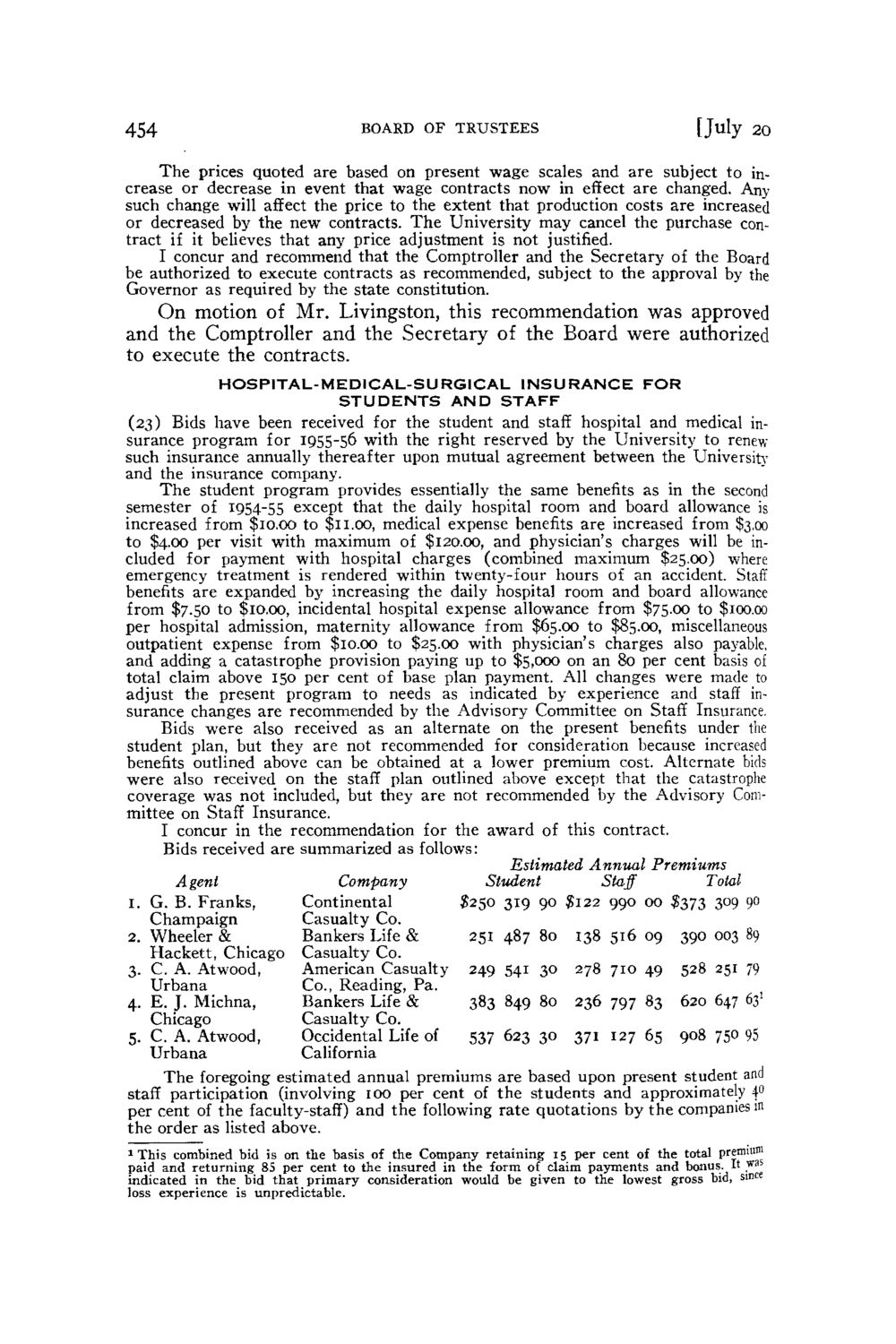

454 BOARD OF TRUSTEES [ J u l y 20 The prices quoted are based on present wage scales and are subject to increase or decrease in event that wage contracts now in effect are changed. Any such change will affect the price to the extent that production costs are increased or decreased by the new contracts. T h e University may cancel the purchase contract if it believes that any price adjustment is not justified. I concur and recommend that the Comptroller and the Secretary of the Board be authorized to execute contracts as recommended, subject to the approval by the Governor as required by the state constitution. On motion of Mr. Livingston, this recommendation was approved and the Comptroller and the Secretary of the Board were authorized to execute the contracts. HOSPITAL-MEDICAL-SURGICAL INSURANCE FOR STUDENTS AND STAFF (23) Bids have been received for the student and staff hospital and medical insurance program for 1955-56 with the right reserved by the University to renew such insurance annually thereafter upon mutual agreement between the University and the insurance company. T h e student program provides essentially the same benefits as in the second semester of 1954-55 except that the daily hospital room and board allowance is increased from $10.00 to $11.00, medical expense benefits are increased from $3,00 to $4.00 per visit with maximum of $120.00, and physician's charges will be included for payment with hospital charges (combined maximum $25.00) where emergency treatment is rendered within twenty-four hours of an accident. Staff benefits are expanded by increasing the daily hospital room and board allowance from $7.50 to $10.00, incidental hospital expense allowance from $75.00 to $100.00 per hospital admission, maternity allowance from $65.00 to $85.00, miscellaneous outpatient expense from $10.00 to $25.00 with physician's charges also payable, and adding a catastrophe provision paying up to $5,000 on an 80 per cent basis of total claim above 150 per cent of base plan payment. All changes were made to adjust the present program to needs as indicated by experience and staff insurance changes are recommended by the Advisory Committee on Staff Insurance. Bids were also received as an alternate on the present benefits under the student plan, but they are not recommended for consideration because increased benefits outlined above can be obtained at a lower premium cost. Alternate bids were also received on the staff plan outlined above except that the catastrophe coverage was not included, but they are not recommended by the Advisory Committee on Staff Insurance. I concur in the recommendation for the award of this contract. Bids received are summarized as follows: Estimated Annual Premiums Agent Company Student Staff Total 1. G. B. Franks, Continental S250 319 90 ?I22 990 00 $373 309 90 Champaign Casualty Co. 2. Wheeler & Bankers Life & 251 487 80 138 516 09 390 003 89 Hackett, Chicago Casualty Co. 3. C. A. Atwood, American Casualty 249 541 30 278 710 49 528 251 79 Urbana Co., Reading, Pa. 4. E. J. Michna, Bankers Life & 383 849 80 236 797 83 620 647 631 Chicago Casualty Co. 5. C. A. Atwood, Occidental Life of 537 623 30 371 127 65 908 750 95 Urbana California The foregoing estimated annual premiums are based upon present student and staff participation (involving 100 per cent of the students and approximately 40 per cent of the faculty-staff) and the following rate quotations by the companies in the order as listed above. This combined bid is on the basis of the Company retaining 15 per cent of the total premiun paid and returning 85 per cent to the insured in the form of claim payments and bonus. It .wa* indicated in the bid that primary consideration would be given to the lowest gross bid, since loss experience is unpredictable. 1

| |