| |

| |

Caption: Board of Trustees Minutes - 1940

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

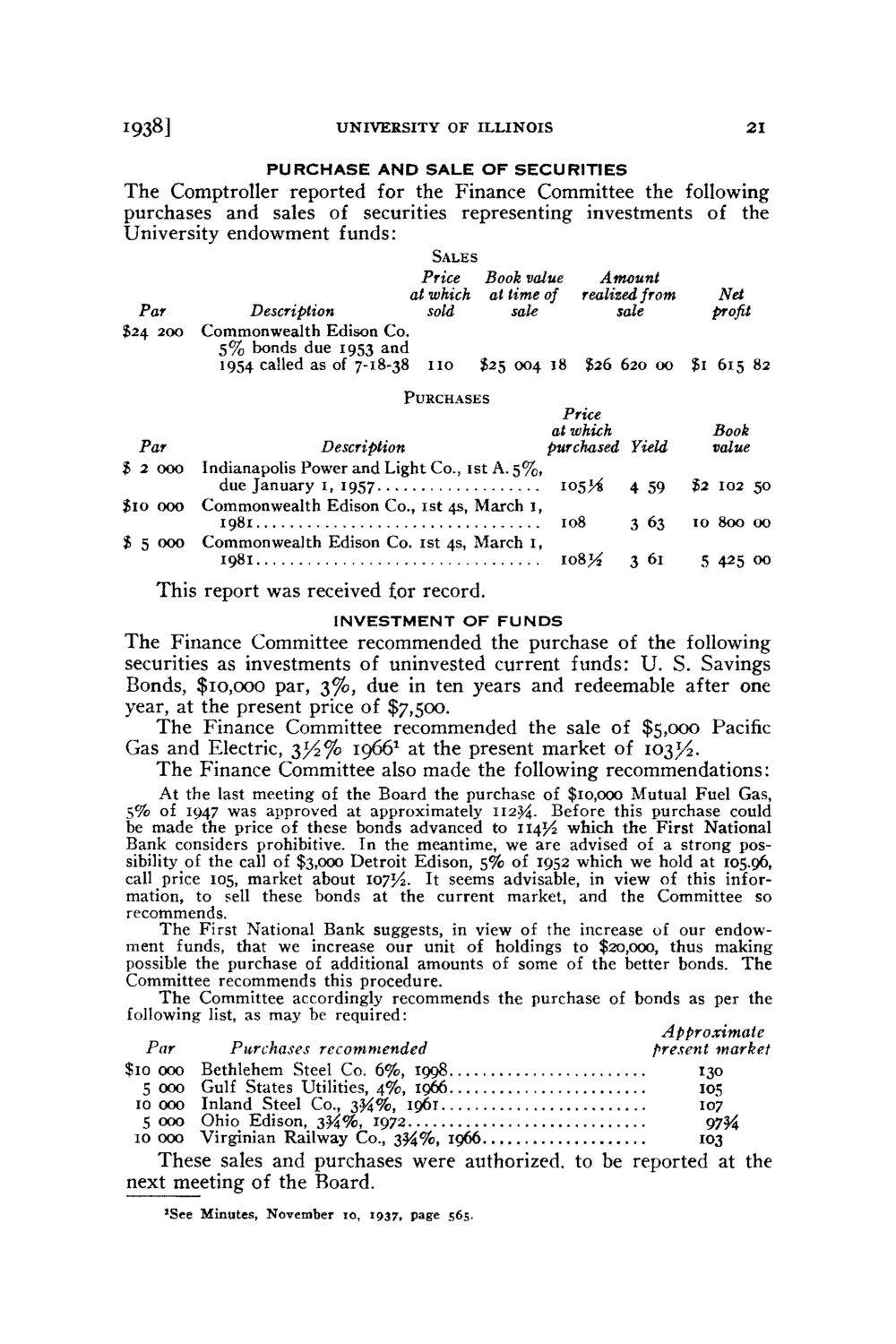

1938] UNIVERSITY OF ILLINOIS PURCHASE A N D SALE OF SECURITIES 21 The Comptroller reported for the Finance Committee the following purchases and sales of securities representing investments of the University endowment funds: SALES Par $24 200 Description Commonwealth Edison Co. 5 % bonds due 1953 and 1954 called as of 7-18-38 Price at which sold no Book value at time of sale $25 004 18 Amount realized from sale $26 620 00 Net profit Ji 615 82 PURCHASES Par $ 2 000 $10 000 $ 5 000 Description Indianapolis Power and Light Co., 1st A. 5 % , due January 1, 1957 Commonwealth Edison Co., 1st 4s, March I, 1981 Commonwealth Edison Co. 1st 4s, March I, 1981 Price at which purchased Yield 105^ 108 108^ 4 59 3 63 361 Book value $2 102 50 10 800 00 542500 This report was received for record. INVESTMENT O F F U N D S The Finance Committee recommended the purchase of the following securities as investments of uninvested current funds: U. S. Savings Bonds, $10,000 par, 3 % , due in ten years and redeemable after one year, at the present price of $7,500. The Finance Committee recommended the sale of $5,000 Pacific Gas and Electric, 3 ^ % 19661 at the present market of 103^2. The Finance Committee also made the following recommendations: At the last meeting of the Board the purchase of $10,000 Mutual Fuel Gas, 5% of 1947 was approved at approximately 112J4. Before this purchase could be made the price of these bonds advanced to 1 1 4 ^ which the First National Bank considers prohibitive. In the meantime, we are advised of a strong possibility of the call of $3,000 Detroit Edison, 5% of 1952 which we hold at 105.96, call price 105, market about 107I/2. It seems advisable, in view of this information, to sell these bonds at the current market, and the Committee so recommends. The First National Bank suggests, in view of the increase of our endowment funds, that we increase our unit of holdings to $20,000, thus making possible the purchase of additional amounts of some of the better bonds. T h e Committee recommends this procedure. T h e Committee accordingly recommends the purchase of bonds as per the following list, as may be required: Approximate Par Purchases recommended present market $10 000 Bethlehem Steel Co. 6%, 1998 130 5 000 Gulf States Utilities, 4%, 1966 105 10 000 Inland Steel Co., 354%, 1961 107 5 000 Ohio Edison, 3^4%, 1972 97J4 10 000 Virginian Railway Co., Z%%< J 966 103 These sales and purchases were authorized, to be reported at the next meeting of the Board. 'See Minutes, November 10, 1937, page 565.

| |