Caption: Board of Trustees Minutes - 1938

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

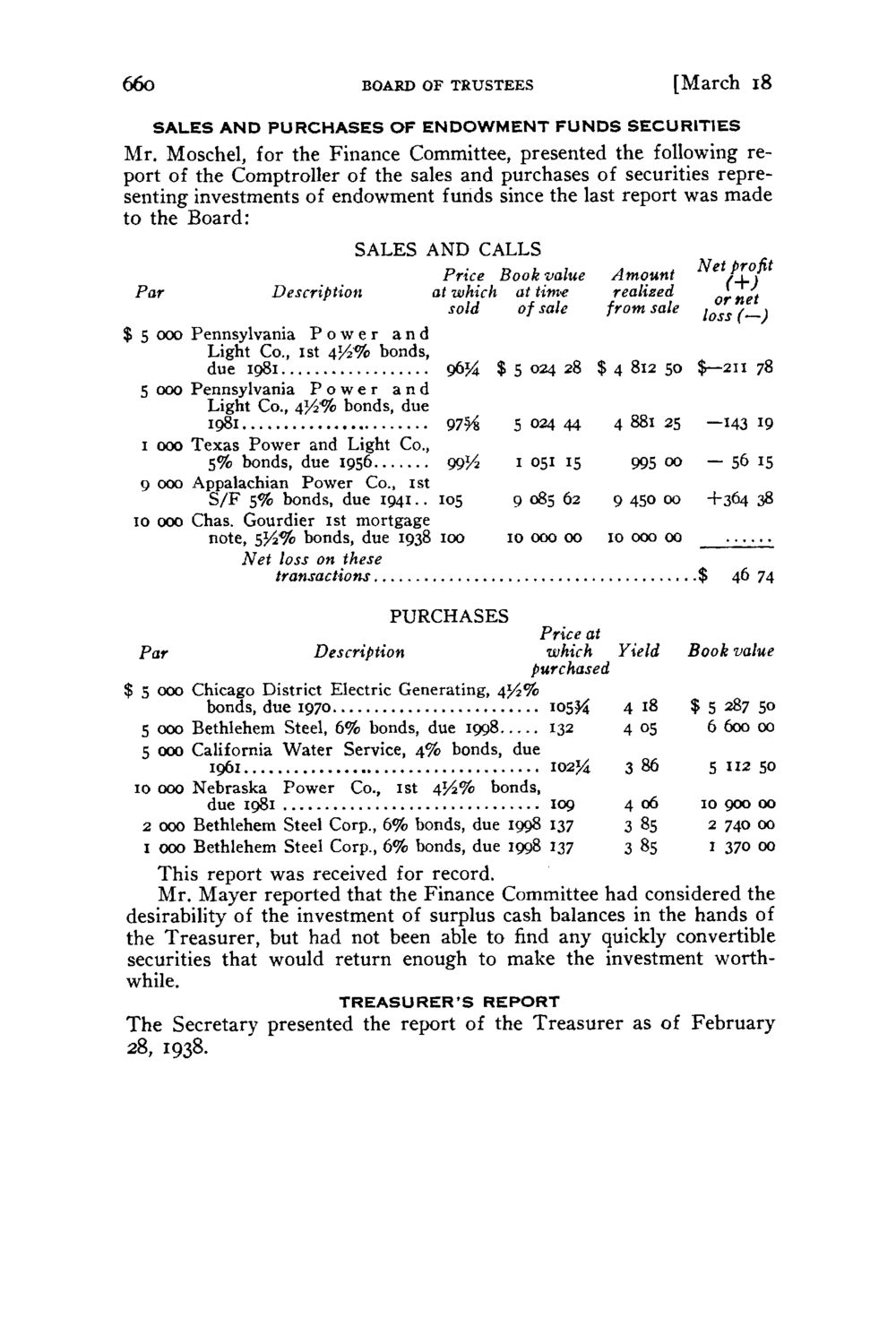

66o BOARD OF TRUSTEES [March 18 SALES A N D PURCHASES OF E N D O W M E N T F U N D S SECURITIES Mr. Moschel, for the Finance Committee, presented the following report of the Comptroller of the sales and purchases of securities representing investments of endowment funds since the last report was made to the Board: SALES AND CALLS Par Description Price Book value at which at time sold of sale Amount realized from sale (+) or net , , , $ 5 ooo Pennsylvania P o w e r and Light Co., 1st i,l/i°/o bonds, due 1081 5 000 Pennsylvania P o w e r and Light Co., 4^2% bonds, due 1981 1 000 T e x a s Power and Light Co., 5% bonds, due 1956 9 000 Appalachian Power Co., 1st S / F 5% bonds, due 1941.. 10 000 Chas. Gourdier 1st mortgage note, 5}4% bonds, due 1938 Net loss on these transactions o6}4 97% 9914 105 100 $502428 5 024 44 1 051 15 9 085 62 10 000 00 $481250 488125 995 00 9 450 00 10 000 00 $—21178 —143 19 — 56 15 + 3 0 4 38 $ 46 74 PURCHASES Par $ 5 000 5 000 5 000 10 000 Price at which purchased Chicago District Electric Generating, 4 j 4 % bonds, due 1970 105J4 Bethlehem Steel, 6% bonds, due 1998 132 California W a t e r Service, 4 % bonds, due 1961 102% Nebraska Power Co., 1st 454% bonds, due 1981 109 Description Yield Book value 418 4 05 386 4 06 $528750 6 600 00 5 112 50 10 900 00 2 000 Bethlehem Steel Corp., 6% bonds, due 1998 137 3 85 2 740 00 1 000 Bethlehem Steel Corp., 6% bonds, due 1998 137 3 85 1 370 00 This report was received for record. Mr. Mayer reported that the Finance Committee had considered the desirability of the investment of surplus cash balances in the hands of the Treasurer, but had not been able to find any quickly convertible securities that would return enough to make the investment worthwhile. TREASURER'S REPORT The Secretary presented the report of the Treasurer as of February 28, 1938.

|