Caption: Board of Trustees Minutes - 1938

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

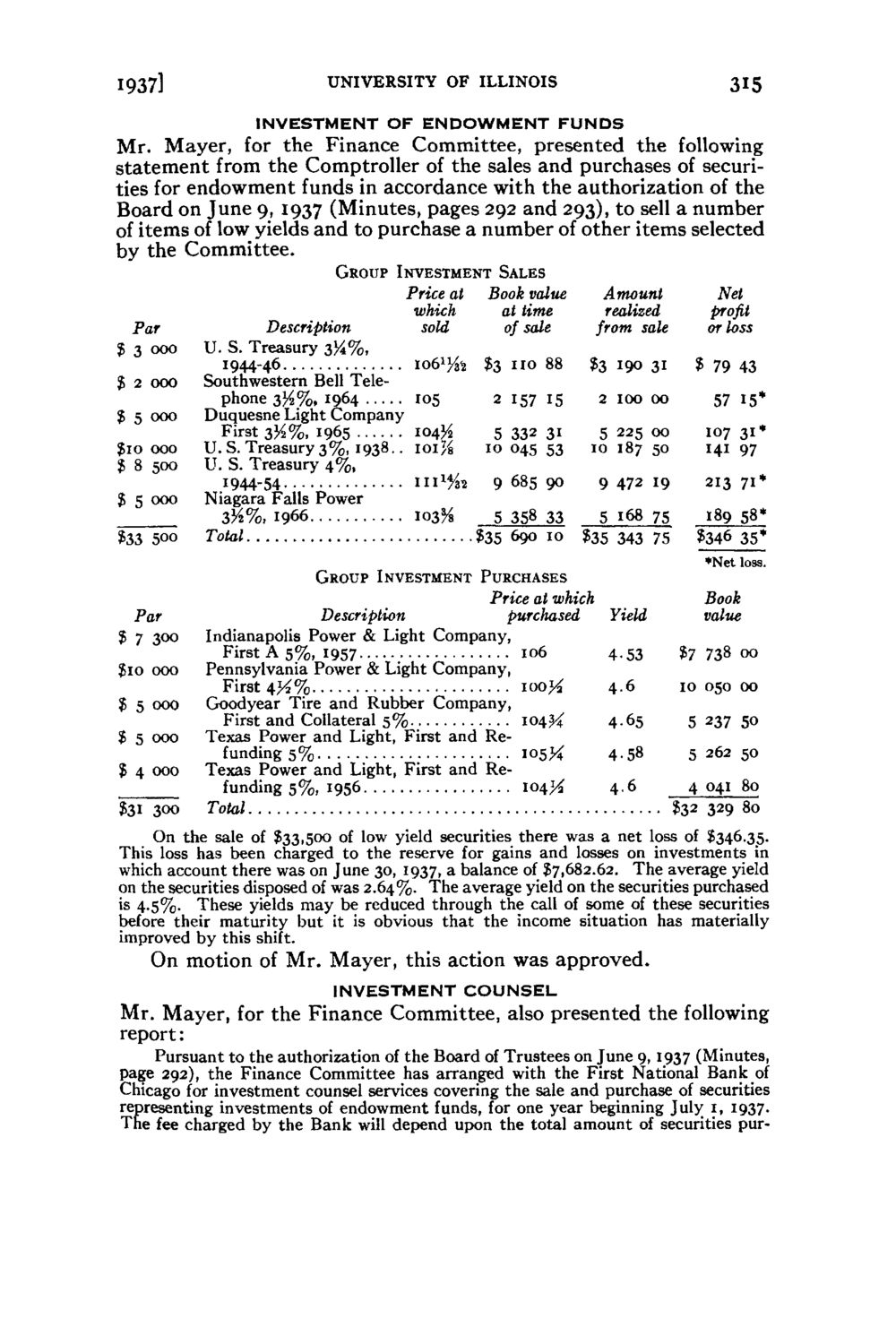

1937] UNIVERSITY OF ILLINOIS INVESTMENT O F E N D O W M E N T F U N D S 315 Mr. Mayer, for the Finance Committee, presented the following statement from the Comptroller of the sales and purchases of securities for endowment funds in accordance with the authorization of the Board on June 9, 1937 (Minutes, pages 292 and 293), to sell a number of items of low yields and to purchase a number of other items selected by the Committee. G R O U P INVESTMENT SALES Par $ 3 000 $ 2 000 $ 5 000 $10 000 $ 8 500 $ 5 000 $33500 Description U. S. Treasury 3 % % , 1944-46 Southwestern Bell Telephone 3%%, 1964 Duquesne Light Company First 3%%, 1965 U . S . Treasury 3 % , 1938.. U. S. Treasury 4 % , 1944-54 Niagara Falls Power 3 H % , 1966 Total Price at which sold 106% 105 104^ 101% 111% 103% Book value at time of sale $311088 2 157 15 5 332 31 10 045 53 968590 5 358 33 $3569010 Amount realized from sale $319031 2 100 00 5 225 00 10 187 50 9 472 19 5 168 75 $35 343 75 Net profit or loss $ 7 9 43 57 15* 107 3 1 * 141 97 213 71* 189 58* $346 35* *Net loss. Book value $773800 1005000 5 237 50 526250 4 041 80 ? 3 2 329 80 Par $ 7 300 $10 000 $ 5 000 $ 5 000 $ 4 000 $31 300 GROUP INVESTMENT PURCHASES Price at which Description purchased Yield Indianapolis Power & Light Company, First A 5%, 1957 106 4.53 Pennsylvania Power & Light Company, First 4 ^ % iooj^ 4.6 Goodyear Tire and Rubber Company, First and Collateral 5 % 104^ 4.65 Texas Power and Light, First and Refunding 5 % 105K 4.58 Texas Power and Light, First and Refunding 5 % , 1956 10414 4.6 Total On the sale of $33,500 of low yield securities there was a net loss of $346.35. This loss has been charged to the reserve for gains and losses on investments in which account there was on June 30, 1937, a balance of $7,682.62. The average yield on the securities disposed of was 2.64%. The average yield on the securities purchased is 4-5%- These yields may be reduced through the call of some of these securities before their maturity but it is obvious that the income situation has materially improved by this shift. On motion of Mr. Mayer, this action was approved. INVESTMENT C O U N S E L Mr. Mayer, for the Finance Committee, also presented the following report: Pursuant to the authorization of the Board of Trustees on June 9, 1937 (Minutes, page 292), the Finance Committee has arranged with the First National Bank of Chicago for investment counsel services covering the sale and purchase of securities representing investments of endowment funds, for one year beginning July 1, 1937. The fee charged by the Bank will depend upon the total amount of securities pur-

|