| |

| |

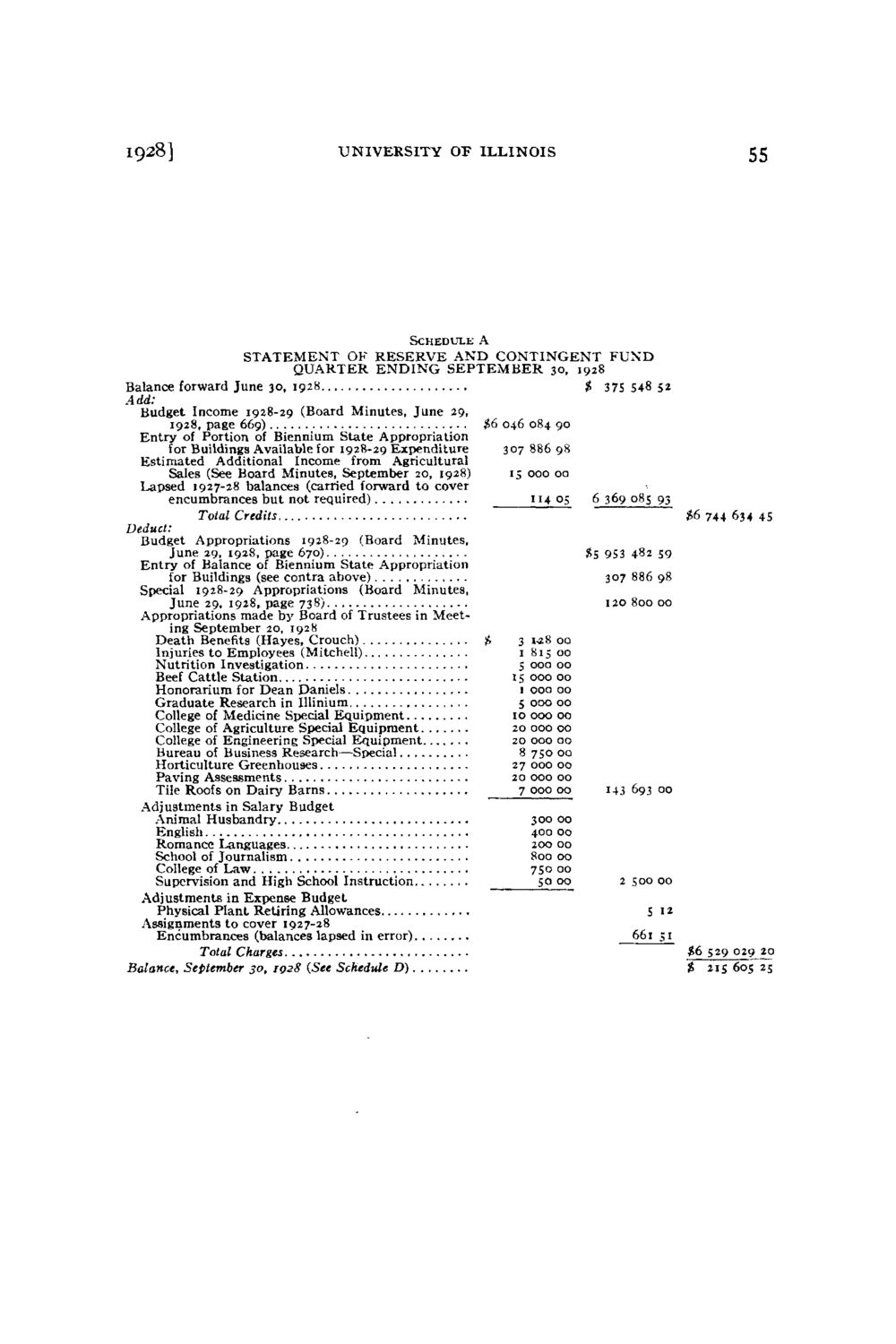

Caption: Board of Trustees Minutes - 1930

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

IQ28] UNIVERSITY OF ILLINOIS 55 Schedule A S T A T E M E N T OK RESERVE A N D C O N T I N G E N T F U N D Q U A R T E R E N D I N G S E P T E M B E R 30, 1928 Balance forward June 30, 1928 $ 375 548 52 Add: Budget Income 1928-29 (Board Minutes, June 29, 1928, page 669) £6 046 084 90 Entry of Portion of Biennium State Appropriation for Buildings Available for 1928-29 Expenditure 307 886 98 Estimated Additional Income from Agricultural Sales (See Board Minutes, September 20, 1928) 15 000 oa Lapsed 1927-28 balances (carried forward to cover encumbrances but not required) 114 05 6 369 085 93 Total Credits $6 744 634 45 Deduct: Budget Appropriations 1928-29 (Board Minutes, June 29, 1928, page 670) #5 953 482 59 Entry of Balance of Biennium State Appropriation for Buildings (see contra above) 307 886 98 Special 1928-29 Appropriations (Board Minutes, June 29, 1928, page 738). 120 800 00 Appropriations made by Board of Trustees in Meeting September 20, 1928 Death Benefits (Hayes, Crouch) £ 3 1 2 00 -8 Injuries to Employees (Mitchell) 1 815 00 Nutrition Investigation 5 00a 00 Beef Cattle Station 15 000 00 Honorarium for Dean Daniels 1 00a 00 Graduate Research in Illinium 5 000 00 College of Medicine Special Equipment 10 000 00 College of Agriculture Special Equipment 20 000 00 College of Engineering Special Equipment 20 000 00 Bureau of Business Research—Special 8 750 00 Horticulture Greenhouses 27 000 00 Paving Assessments 20 000 00 Tile Roofs on Dairy Barns 7 000 00 143 693 00 Adjustments in Salary Budget Animal Husbandry 300 00 English 400 00 Romance Languages 200 00 School of Journalism 800 00 College of Law 750 00 Supervision and High School Instruction 50 00 2 500 00 Adjustments in Expense Budget Physical Plant Retiring Allowances 5 12 Assignments to cover 1927-28 Encumbrances (balances lapsed in error) 661 51 Total Charges $6 529 029 10 Balance, September 50, 1928 (See Schedule D) $ 215 605 25

| |