| |

| |

Caption: Board of Trustees Minutes - 1928

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

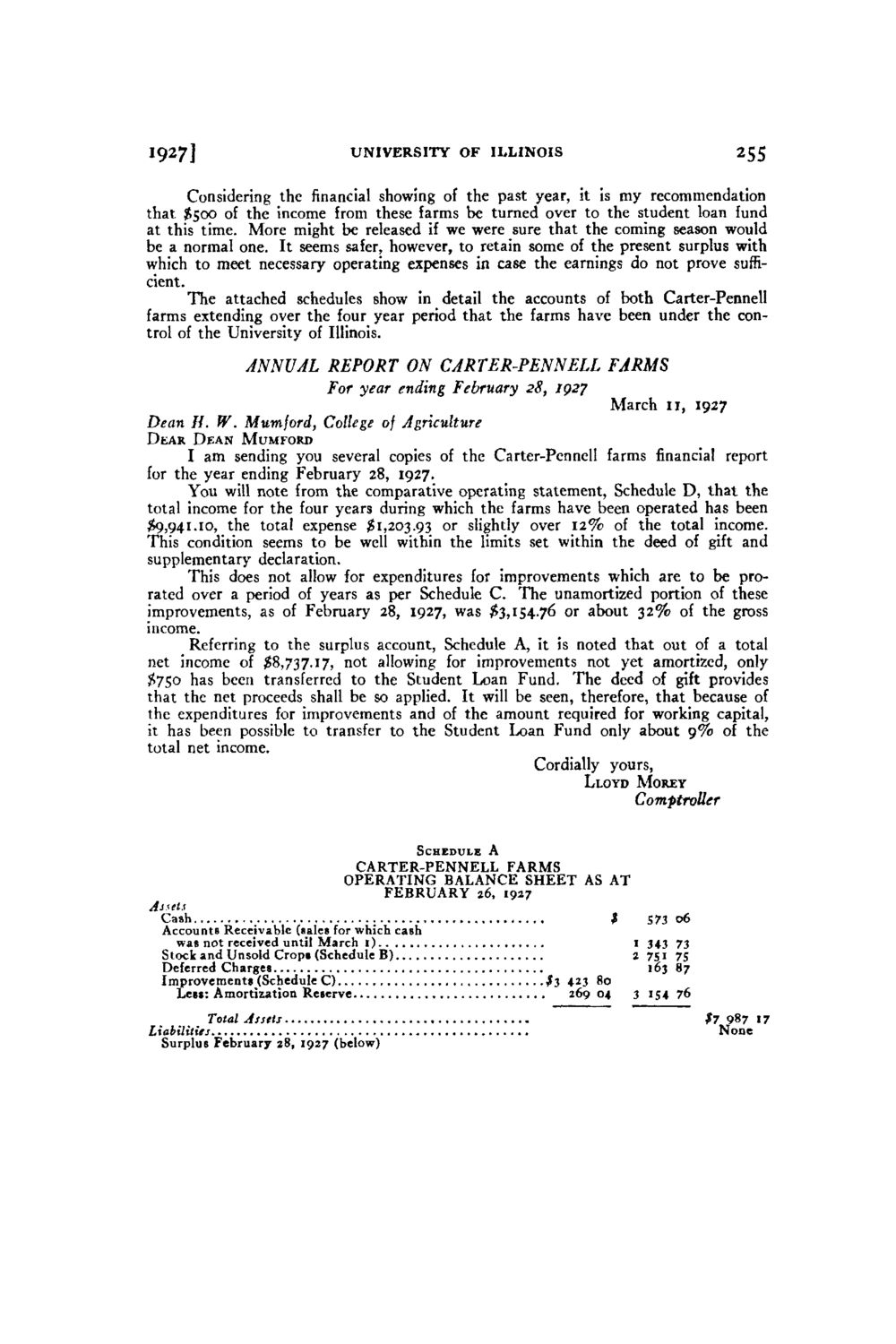

1927] U N I V E R S I T Y O F ILLINOIS 255 Considering thefinancialshowing of the past year, it is m y recommendation that $500 of the income from these farms be turned over to the student loan fund at this time. More might be released if we were sure that the coming season would be a normal one. It seems safer, however, to retain some of the present surplus with which to meet necessary operating expenses in case the earnings do not prove sufficient. The attached schedules show in detail the accounts of both Carter-Pennell farms extending over the four year period that the farms have been under the control of the University of Illinois. ANNUAL REPORT ON CARTER-PENNELL FARMS For year ending February 28, 1927 March 11, 1927 Dean H . W . Mumjord, College of Agriculture Dear Dean Mumford I a m sending you several copies of the Carter-Pennell farms financial report for the year ending February 28, 1927. Y o u will note from the comparative operating statement, Schedule D, that the total income for the four years during which the farms have been operated has been $9,941.10, the total expense £1,203.93 or slightly over 1 2 % of the total income. This condition seems to be well within the limits set within the deed of gift and supplementary declaration. This does not allow for expenditures for improvements which are to be prorated over a period of years as per Schedule C. The unamortized portion of these improvements, as of February 28, 1927, was $3,154.76 or about 3 2 % of the gross income. Referring to the surplus account, Schedule A, it is noted that out of a total net income of $8,737.17, not allowing for improvements not yet amortized, only $750 has been transferred to the Student Loan Fund. The deed of gift provides that the net proceeds shall be so applied. It will be seen, therefore, that because of the expenditures for improvements and of the amount required for working capital, it has been possible to transfer to the Student Loan Fund only about 9 % of the total net income. Schedule A Cordially yours, CARTER-PENNELL FARMS OPERATING BALANCE SHEET Lloyd Morey AS AT Comptroller FEBRUARY 26, 1 2 97 Anns Cash Accounts Receivable (sales for which cash was not received until March 1) Stock and Unsold Cropa (Schedule B) Deferred Charges Improvements (Schedule C) Less: Amortization Reserve Total Asstl; Liabilities Surplus February 28, 1927 (below) I 3*3 73 $ 2 573 75 751 06 163 87 3 154 76 $7 987 17 None fi +23 80 269 04

| |