| |

| |

Caption: Board of Trustees Minutes - 1978

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

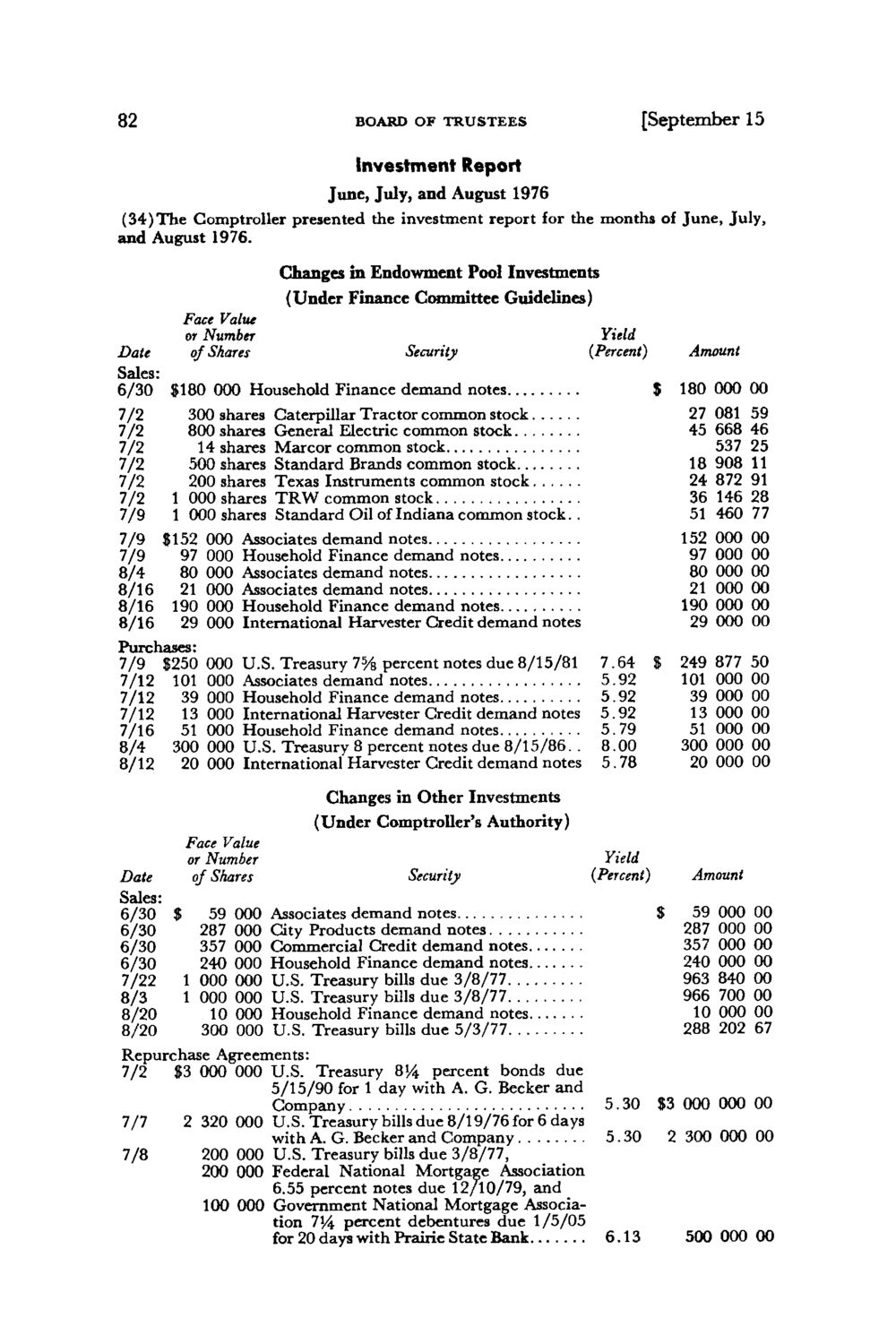

82 BOARD OF TRUSTEES [September 15 Investment Report June, July, and August 1976 (34)The Comptroller presented the investment report for the months of June, July, and August 1976. Changes in Endowment Pool Investments (Under Finance Committee Guidelines) Yield Amount Date Security [Percent) Sales: % 180 000 00 6/30 $180 000 Household Finance demand notes 27 081 59 7/2 300 shares Caterpillar Tractor common stock 45 668 46 7/2 800 shares General Electric common stock 537 25 7/2 14 shares Marcor common stock 18 908 11 7/2 500 shares Standard Brands common stock 24 872 91 7/2 200 shares Texas Instruments common stock 36 146 28 7/2 1 000 shares T R W common stock 51 460 77 7/9 1 000 shares Standard Oil of Indiana common stock. . 152 000 00 7/9 $152 000 Associates demand notes 97 000 00 7/9 97 000 Household Finance demand notes 80 000 00 8/4 80 000 Associates demand notes 21 000 00 8/16 21 000 Associates demand notes 190 000 00 8/16 190 000 Household Finance demand notes 29 000 00 8/16 29 000 International Harvester Credit demand notes Purchases: 7/9 S250 000 U.S. Treasury 75/B percent notes due 8/15/81 7.64 $ 249 877 50 101 000 00 7/12 101 000 Associates demand notes 5.92 39 000 00 7/12 39 000 Household Finance demand notes 5.92 13 000 00 7/12 13 000 International Harvester Credit demand notes 5.92 51 000 00 7/16 51 000 Household Finance demand notes 5.79 300 000 00 8/4 300 000 U.S. Treasury 8 percent notes due 8/15/86. . 8.00 20 000 00 8/12 20 000 International Harvester Credit demand notes 5.78 Changes in Other Investments (Under Comptroller's Authority) Yield Amount Date Security {Percent) Sales: 59 000 00 6/30 $ 59 000 Associates demand notes 287 000 00 6/30 287 000 City Products demand notes 357 000 00 6/30 357 000 Commercial Credit demand notes 240 000 00 6/30 240 000 Household Finance demand notes 963 840 00 7/22 1 000 000 U.S. Treasury bills due 3/8/77 966 700 00 8/3 1 000 000 U.S. Treasury bills due 3/8/77 10 000 00 8/20 10 000 Household Finance demand notes 288 202 67 8/20 300 000 U.S. Treasury bills due 5/3/77 Repurchase Agreements: 7/2 $3 000 000 U.S. Treasury 8<4 percent bonds due 5/15/90 for 1 day with A. G. Becker and Company 5.30 $3 000 000 00 7/7 2 320 000 U.S. Treasury bills due 8/19/76 for 6 days 2 300 000 00 with A. G. Becker and Company 5.30 7/8 200 000 U.S. Treasury bills due 3/8/77, 200 000 Federal National Mortgage Association 6.55 percent notes due 12/10/79, and 100 000 Government National Mortgage Association 7V4 percent debentures due 1/5/05 500 000 00 for 20 days with Prairie State Bank 6.13 Face Value or Number of Shares Face Value or Number of Shares

| |