| |

| |

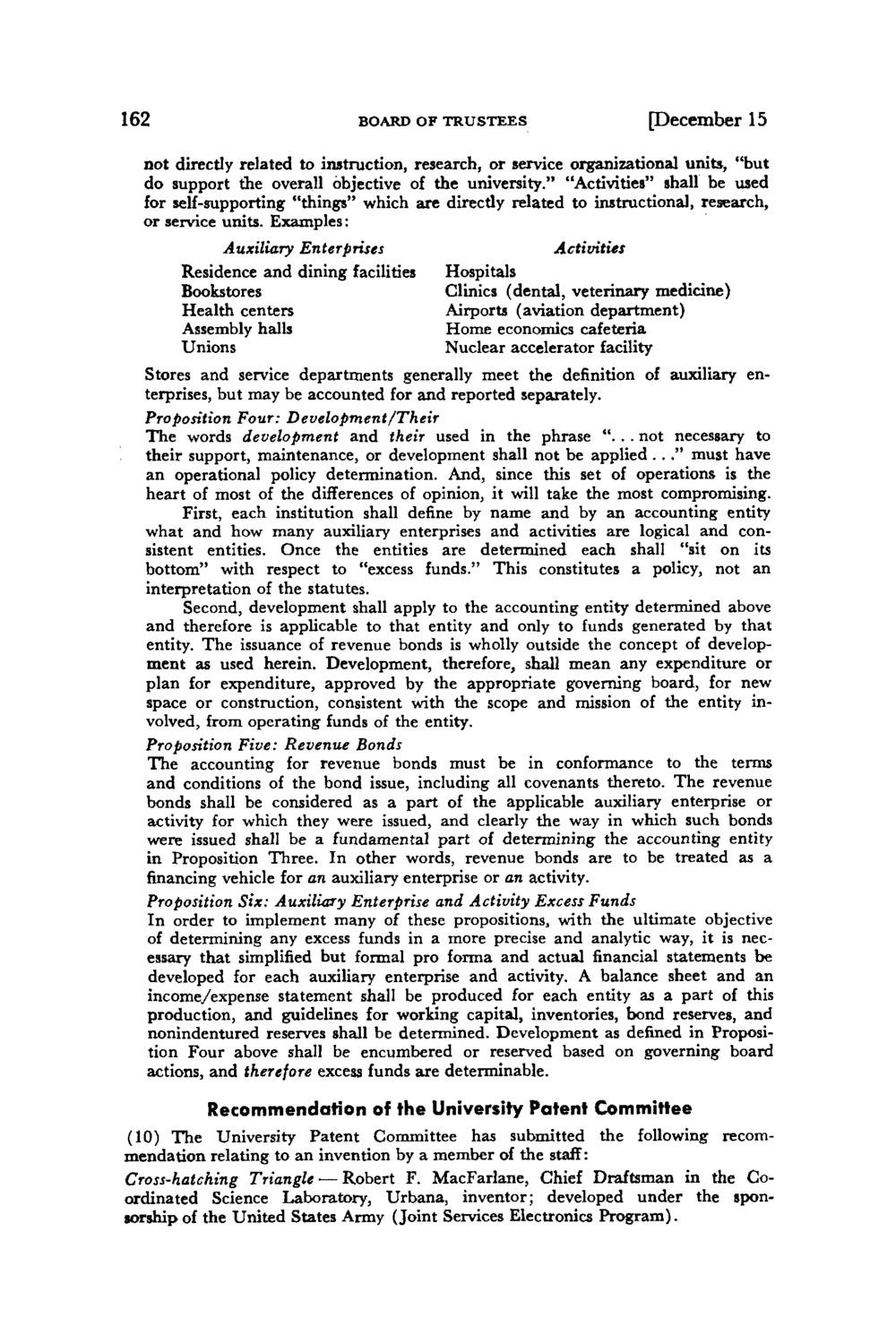

Caption: Board of Trustees Minutes - 1978

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

162 BOARD OF TRUSTEES [December 15 not directly related to instruction, research, or service organizational units, "but do support the overall objective of the university." "Activities" shall be used for self-supporting "things" which are directly related to instructional, research, or service units. Examples: Auxiliary Enterprises Residence and dining facilities Bookstores Health centers Assembly halls Unions Activities Hospitals Clinics (dental, veterinary medicine) Airports (aviation department) Home economics cafeteria Nuclear accelerator facility Stores and service departments generally meet the definition of auxiliary enterprises, but may be accounted for and reported separately. Proposition Four: Development/Their The words development and their used in the phrase ". . . not necessary to their support, maintenance, or development shall not be applied . . ." must have an operational policy determination. And, since this set of operations is the heart of most of the differences of opinion, it will take the most compromising. First, each institution shall define by name and by an accounting entity what and how many auxiliary enterprises and activities are logical and consistent entities. Once the entities are determined each shall "sit on its bottom" with respect to "excess funds." This constitutes a policy, not an interpretation of the statutes. Second, development shall apply to the accounting entity determined above and therefore is applicable to that entity and only to funds generated by that entity. The issuance of revenue bonds is wholly outside the concept of development as used herein. Development, therefore, shall mean any expenditure or plan for expenditure, approved by the appropriate governing board, for new space or construction, consistent with the scope and mission of the entity involved, from operating funds of the entity. Proposition Five: Revenue Bonds The accounting for revenue bonds must be in conformance to the terms and conditions of the bond issue, including all covenants thereto. The revenue bonds shall be considered as a part of the applicable auxiliary enterprise or activity for which they were issued, and clearly the way in which such bonds were issued shall be a fundamental part of determining the accounting entity in Proposition Three. In other words, revenue bonds are to be treated as a financing vehicle for an auxiliary enterprise or an activity. Proposition Six: Auxiliary Enterprise and Activity Excess Funds In order to implement many of these propositions, with the ultimate objective of determining any excess funds in a more precise and analytic way, it is necessary that simplified but formal pro forma and actual financial statements be developed for each auxiliary enterprise and activity. A balance sheet and an income/expense statement shall be produced for each entity as a part of this production, and guidelines for working capital, inventories, bond reserves, and nonindentured reserves shall be determined. Development as defined in Proposition Four above shall be encumbered or reserved based on governing board actions, and therefore excess funds are determinable. Recommendation of the University Patent Committee (10) The University Patent Committee has submitted the following recommendation relating to an invention by a member of the staff: Cross-hatching Triangle •— Robert F. MacFarlane, Chief Draftsman in the Coordinated Science Laboratory, Urbana, inventor; developed under the sponsorship of the United States Army (Joint Services Electronics Program).

| |