Caption: Board of Trustees Minutes - 1976

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

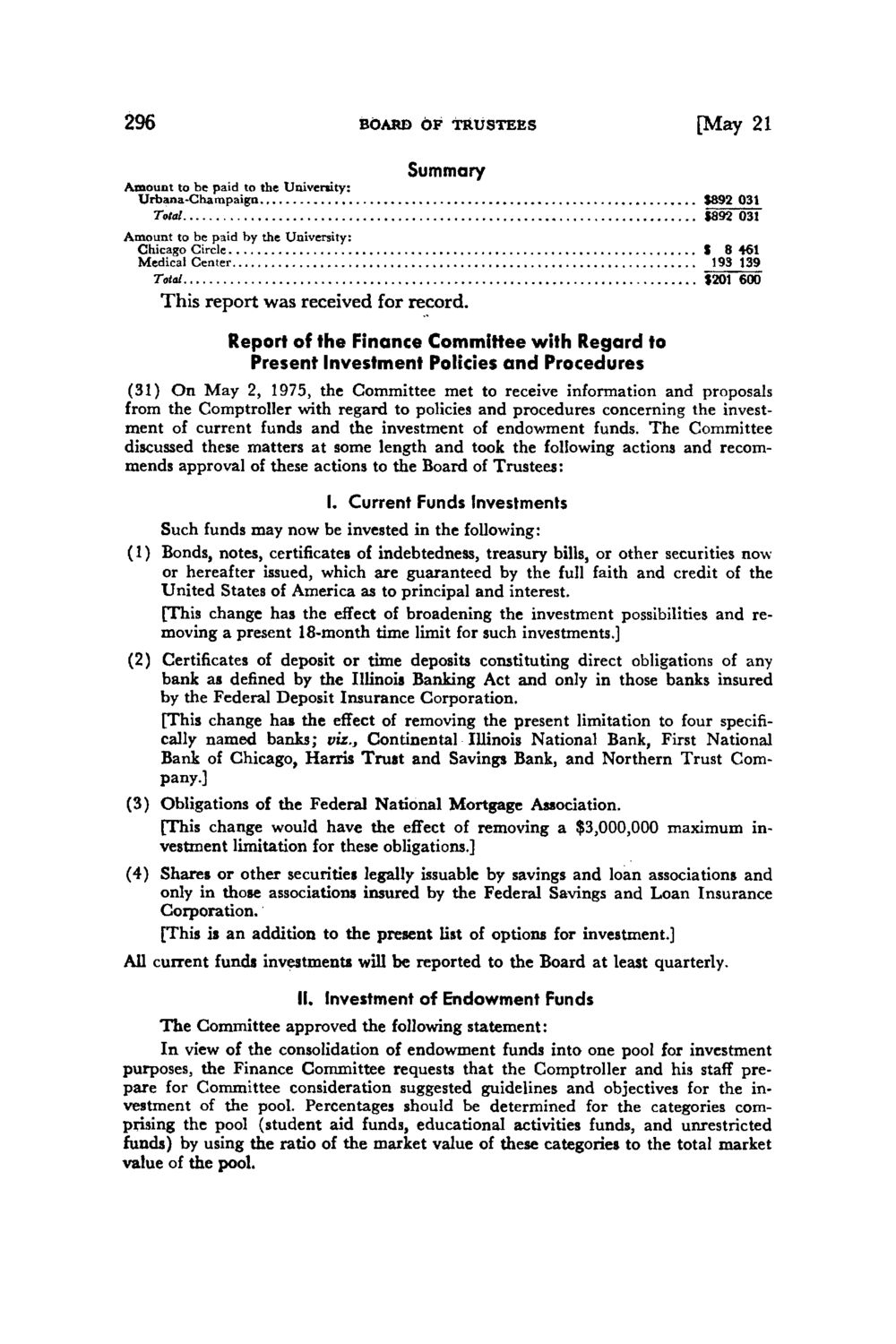

296 Amount to be paid to the University: Urbana-Champaign Total Amount to be paid by the University: Chicago Circle Medical Center Total BOARD OF TRUSTEES [May 21 Summary J892 031 $892 031 t 8 461 193 139 1201 600 T h i s report w a s received for record. Report of the Finance Committee with Regard to Present Investment Policies and Procedures (31) On May 2, 1975, the Committee met to receive information and proposals from the Comptroller with regard to policies and procedures concerning the investment of current funds and the investment of endowment funds. The Committee discussed these matters at some length and took the following actions and recommends approval of these actions to the Board of Trustees: I. Current Funds Investments Such funds may now be invested in the following: (1) Bonds, notes, certificates of indebtedness, treasury bills, or other securities now or hereafter issued, which are guaranteed by the full faith and credit of the United States of America as to principal and interest. [This change has the effect of broadening the investment possibilities and removing a present 18-month time limit for such investments.] (2) Certificates of deposit or time deposits constituting direct obligations of any bank as defined by the Illinois Banking Act and only in those banks insured by the Federal Deposit Insurance Corporation. [This change has the effect of removing the present limitation to four specifically named banks; viz., Continental Illinois National Bank, First National Bank of Chicago, Harris Trust and Savings Bank, and Northern Trust Company.] (3) Obligations of the Federal National Mortgage Association. [This change would have the effect of removing a $3,000,000 maximum investment limitation for these obligations.] (4) Shares or other securities legally issuable by savings and loan associations and only in those associations insured by the Federal Savings and Loan Insurance Corporation. [This is an addition to the present list of options for investment.] All current funds investments will be reported to the Board at least quarterly. II. Investment of Endowment Funds The Committee approved the following statement: In view of the consolidation of endowment funds into one pool for investment purposes, the Finance Committee requests that the Comptroller and his staff prepare for Committee consideration suggested guidelines and objectives for the investment of the pool. Percentages should be determined for the categories comprising the pool (student aid funds, educational activities funds, and unrestricted funds) by using the ratio of the market value of these categories to the total market value of the pool.

|