| |

| |

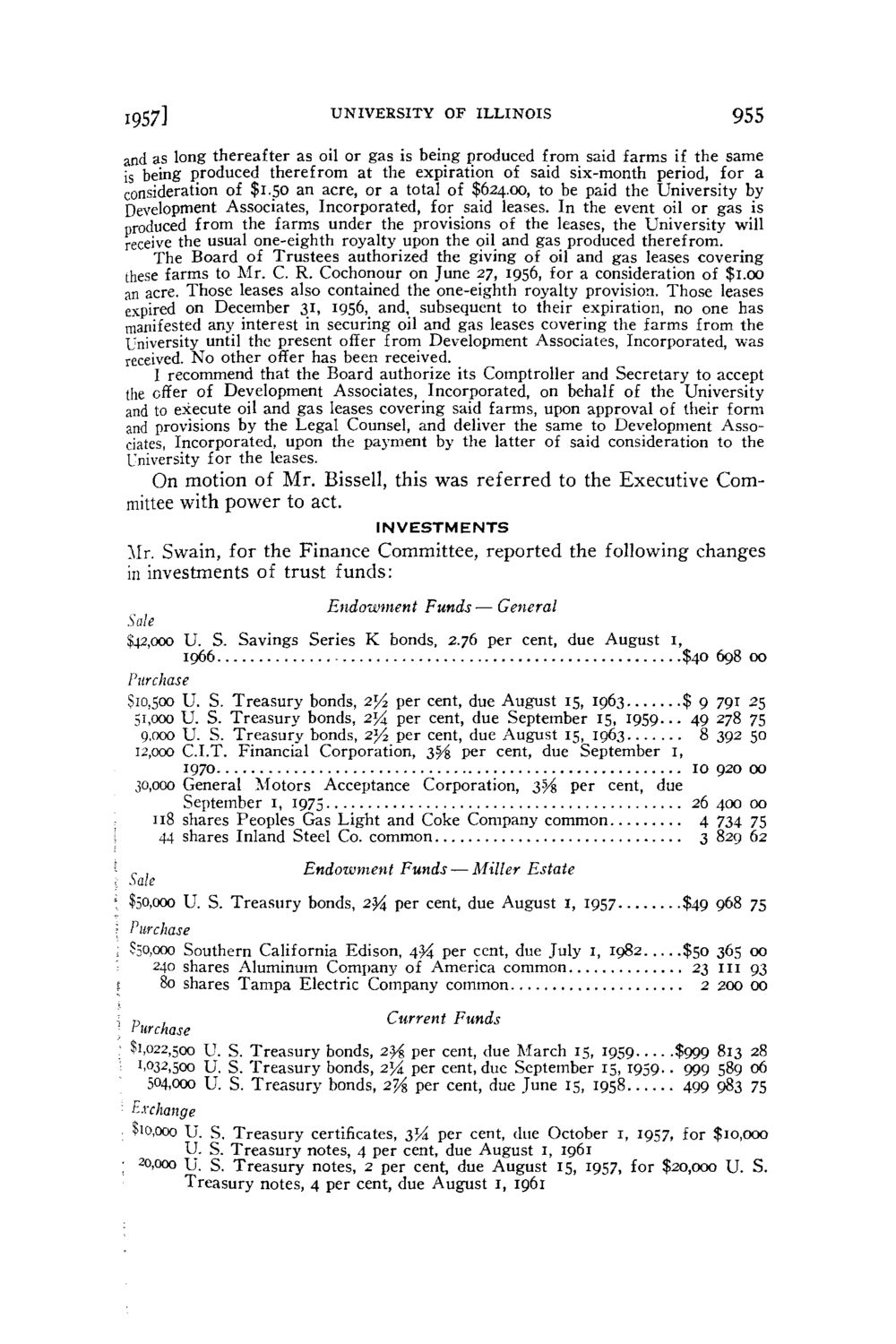

Caption: Board of Trustees Minutes - 1958

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

1957] UNIVERSITY OF ILLINOIS 955 and as long thereafter as oil or gas is being produced from said farms if the same is being produced therefrom at the expiration of said six-month period, for a consideration of $1.50 an acre, or a total of $624.00, to be paid the University by Development Associates, Incorporated, for said leases. In the event oil or gas is produced from the farms under the provisions of the leases, the University will receive the usual one-eighth royalty upon the oil and gas produced therefrom. The Board of Trustees authorized the giving of oil and gas leases covering these farms to Mr. C. R. Cochonour on June 27, 1956, for a consideration of $1.00 an acre. Those leases also contained the one-eighth royalty provision. Those leases expired on December 31, 1956, and, subsequent to their expiration, no one has manifested any interest in securing oil and gas leases covering the farms from the University until the present offer from Development Associates, Incorporated, was received. No other offer has been received. I recommend that the Board authorize its Comptroller and Secretary to accept (he offer of Development Associates, Incorporated, on behalf of the University and to execute oil and gas leases covering said farms, upon approval of their form and provisions by the Legal Counsel, and deliver the same to Development Associates, Incorporated, upon the payment by the latter of said consideration to the University for the leases. On motion of Mr. Bissell, this was referred to the Executive Committee with power to act. INVESTMENTS Mr. Swain, for the Finance Committee, reported the following changes in investments of trust funds: Endowment Funds — General Sale $42,000 U. S. Savings Series K bonds, 2.76 per cent, due August 1, 1966 $40 Purchase $10,500 U. S. Treasury bonds, 2l/2 per cent, due August 15, 1963 $ 9 51,000 U. S. Treasury bonds, 2j4 per cent, due September 15, 1959... 49 9,000 U. S. Treasury bonds, 2J/2 per cent, due August 15, 1963 8 12,000 C.I.T. Financial Corporation, iVi per cent, due September 1, 1970 10 30,000 General Motors Acceptance Corporation, 3% per cent, due September 1, 1975 26 118 shares Peoples Gas Light and Coke Company common 4 44 shares Inland Steel Co. common 3 Endowment Funds — Miller Estate r , Sale $50,000 U. S. Treasury bonds, 2j4 per cent, due August I, 1957 ; Purchase , $50,000 Southern California Edison, 4% per cent, due July 1, 1982 240 shares Aluminum Company of America common 1 80 shares Tampa Electric Company common 698 00 791 25 278 75 392 50 920 00 400 00 734 75 829 62 $49 968 75 $50 365 00 23 m 93 2 200 00 \ n , Current Funds Purchase : $1,022,500 U. S. Treasury bonds, 2% per cent, due March 15, 1959 $999 813 28 ',032,500 U. S. Treasury bonds, 2*4 per cent, due September 15, 1959. . 999 589 06 504,000 U. S. Treasury bonds, 2% per cent, due June 15, 1958 499 083 75 : Exchange . $10,000 U. S. Treasury certificates, 3^4 per cent, due October 1, 1957, for $10,000 U. S. Treasury notes, 4 per cent, due August 1, 1961 ; 20,000 U. S. Treasury notes, 2 per cent, due August 15, 1957, for $20,000 U. S. Treasury notes, 4 per cent, due August 1, 1961

| |