| |

| |

Caption: Board of Trustees Minutes - 1958

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

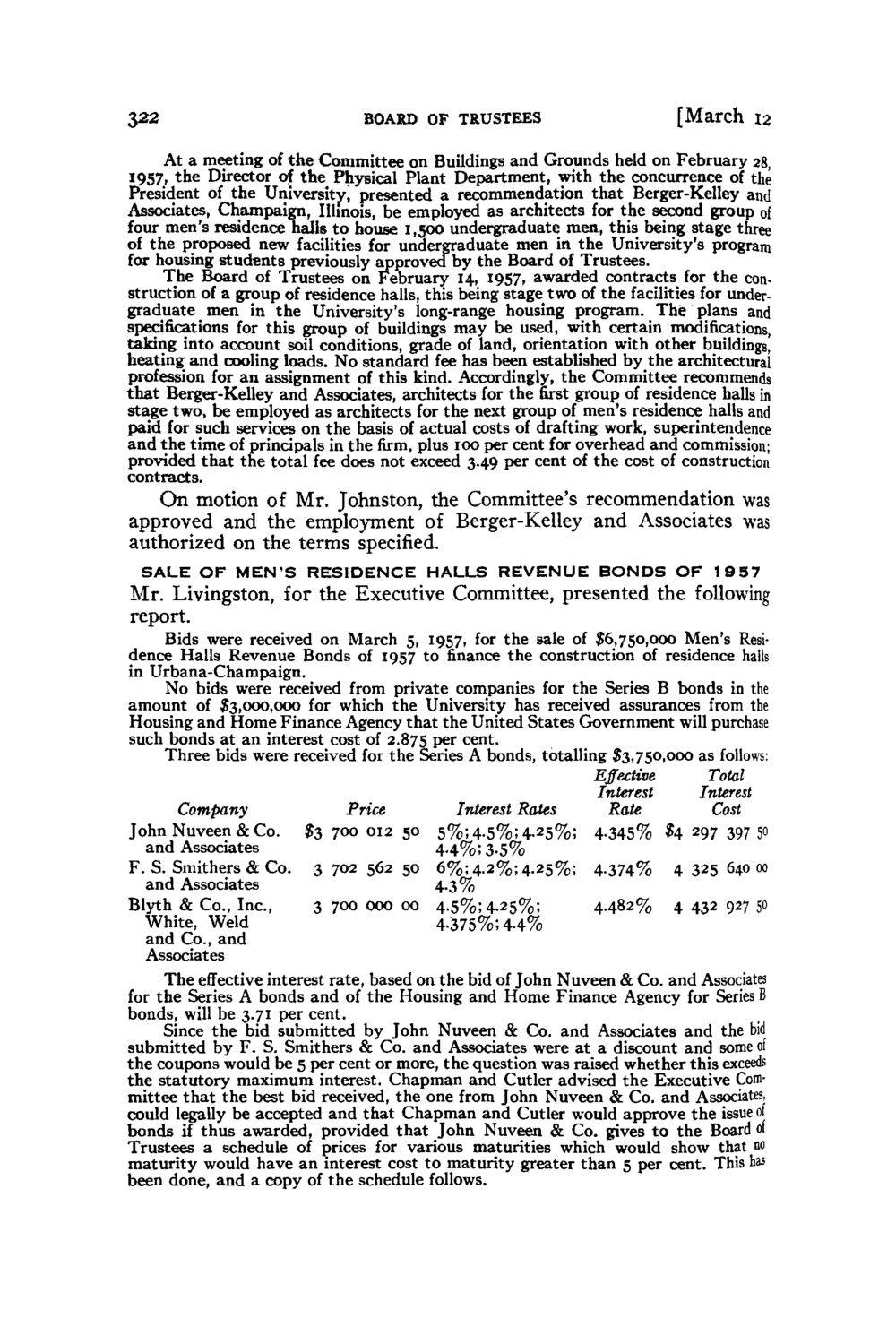

322 BOARD O F T R U S T E E S [March 12 At a meeting of the Committee on Buildings and Grounds held on February 28, 1957, the Director of the Physical Plant Department, with the concurrence of the President of the University, presented a recommendation that Berger-Kelley and Associates, Champaign, Illinois, be employed as architects for the second group of four men's residence halls to house 1,500 undergraduate men, this_ being stage three of the proposed new facilities for undergraduate men in the University's program for housing students previously approved by the Board of Trustees. The Board of Trustees on February 14, 1957, awarded contracts for the construction of a group of residence halls, this being stage two of the facilities for undergraduate men in the University's long-range housing program. The plans and specifications for this group of buildings may be used, with certain modifications, taking into account soil conditions, grade of land, orientation with other buildings, heating and cooling loads. No standard fee has been established by the architectural profession for an assignment of this kind. Accordingly, the Committee recommends that Berger-Kelley and Associates, architects for the first group of residence halls in stage two, be employed as architects for the next group of men's residence halls and paid for such services on the basis of actual costs of drafting work, superintendence and the time of principals in the firm, plus 100 per cent for overhead and commission; provided that the total fee does not exceed 3.49 per cent of the cost of construction contracts. On motion of Mr. Johnston, the Committee's recommendation was approved and the employment of Berger-Kelley and Associates was authorized on the terms specified. SALE OF MEN'S RESIDENCE HALLS REVENUE B O N D S OF 1957 Mr. Livingston, for the Executive Committee, presented the following report. Bids were received on March 5, 1957, for the sale of $6,750,000 Men's Residence Halls Revenue Bonds of 1957 to finance the construction of residence halls in Urbana-Champaign. No bids were received from private companies for the Series B bonds in the amount of $3,000,000 for which the University has received assurances from the Housing and Home Finance Agency that the United States Government will purchase such bonds at an interest cost of 2.875 P& cent. Three bids were received for the Series A bonds, totalling $3,750,000 as follows: Effective Total Interest Interest Company Price Interest Rates Rate Cost John Nuveen & Co. $3 700 012 50 5%; 4.5%; +.25%; 4.345% $4 297 39750 and Associates 4-4%; 3-5% F. S. Smithers & Co. 3 7 0 2 5 6 2 5 0 6%; 4.2%; 4.25%; 4.374% 432564000 and Associates 4-3% Blyth & Co., Inc., 3 700 000 00 4.5%; 4.25%; 4482%, 4 432 927 50 White, Weld 4-375%; 4-4% and Co., and Associates The effective interest rate, based on the bid of John Nuveen & Co. and Associates for the Series A bonds and of the Housing and Home Finance Agency for Series B bonds, will be 3.71 per cent. Since the bid submitted by John Nuveen & Co. and Associates and the bid submitted by F. S. Smithers & Co. and Associates were at a discount and some of the coupons would be 5 per cent or more, the question was raised whether this exceeds the statutory maximum interest. Chapman and Cutler advised the Executive Committee that the best bid received, the one from John Nuveen & Co. and Associates, could legally be accepted and that Chapman and Cutler would approve the issue 0 bonds if thus awarded, provided that John Nuveen & Co. gives to the Board of Trustees a schedule of prices for various maturities which would show that no maturity would have an interest cost to maturity greater than 5 per cent. This has been done, and a copy of the schedule follows.

| |