| |

| |

Caption: Board of Trustees Minutes - 1950

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

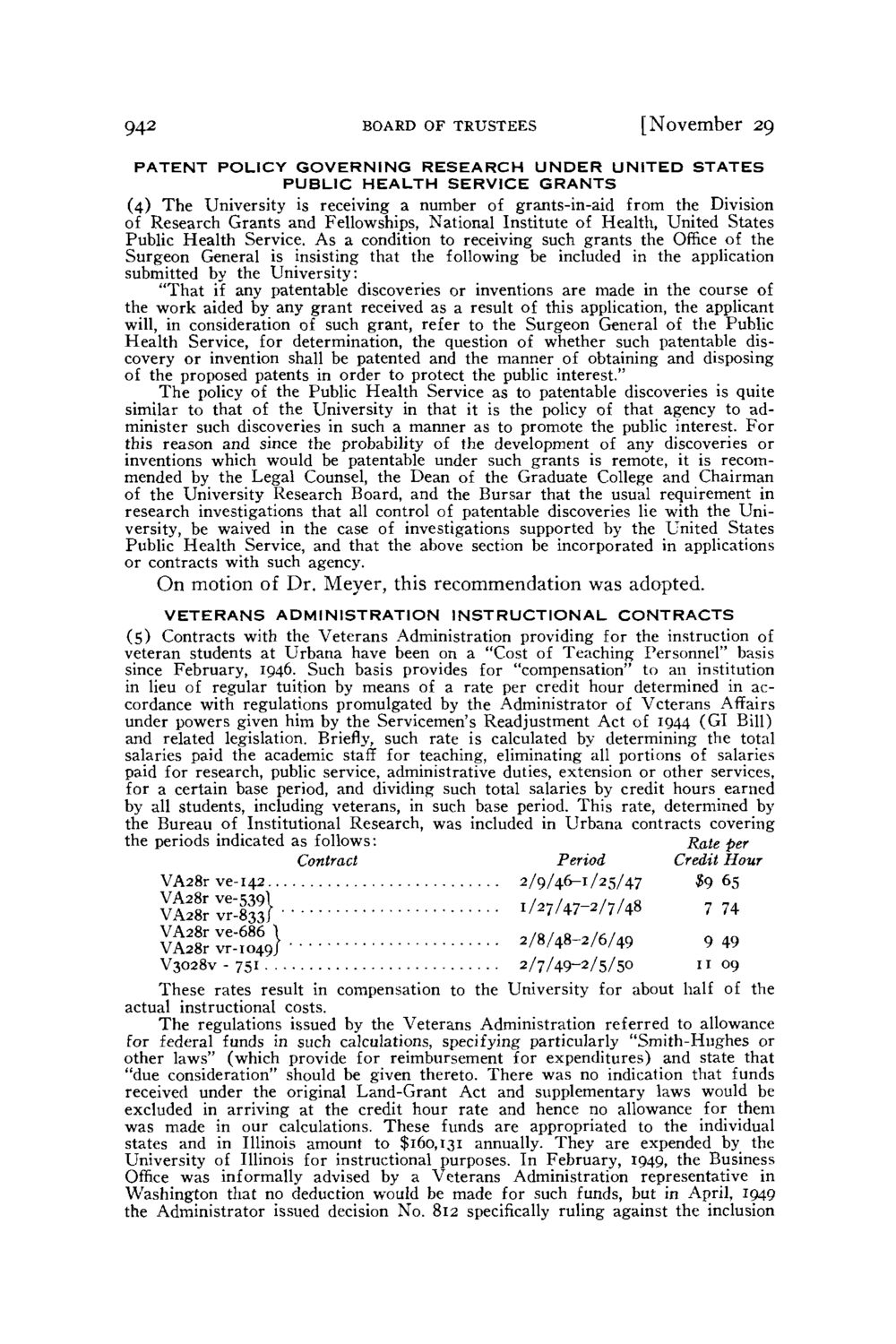

942 BOARD OF TRUSTEES [November 29 PATENT POLICY GOVERNING RESEARCH UNDER UNITED STATES PUBLIC HEALTH SERVICE GRANTS (4) The University is receiving a number of grants-in-aid from the Division of Research Grants and Fellowships, National Institute of Health, United States Public Health Service. As a condition to receiving such grants the Office of the Surgeon General is insisting that the following be included in the application submitted by the University: "That if any patentable discoveries or inventions are made in the course of the work aided by any grant received as a result of this application, the applicant will, in consideration of such grant, refer to the Surgeon General of the Public Health Service, for determination, the question of whether such patentable discovery or invention shall be patented and the manner of obtaining and disposing of the proposed patents in order to protect the public interest." The policy of the Public Health Service as to patentable discoveries is quite similar to that of the University in that it is the policy of that agency to administer such discoveries in such a manner as to promote the public interest. For this reason and since the probability of the development of any discoveries or inventions which would be patentable under such grants is remote, it is recommended by the Legal Counsel, the Dean of the Graduate College and Chairman of the University Research Board, and the Bursar that the usual requirement in research investigations that all control of patentable discoveries lie with the University, be waived in the case of investigations supported by the United States Public Health Service, and that the above section be incorporated in applications or contracts with such agency. On motion of Dr. Meyer, this recommendation was adopted. VETERANS ADMINISTRATION INSTRUCTIONAL CONTRACTS (5) Contracts with the Veterans Administration providing for the instruction of veteran students at Urbana have been on a "Cost of Teaching Personnel" basis since February, 1946. Such basis provides for "compensation" to an institution in lieu of regular tuition by means of a rate per credit hour determined in accordance with regulations promulgated by the Administrator of Veterans Affairs under powers given him by the Servicemen's Readjustment Act of 1944 (GI Bill) and related legislation. Briefly, such rate is calculated by determining the total salaries paid the academic staff for teaching, eliminating all portions of salaries paid for research, public service, administrative duties, extension or other services, for a certain base period, and dividing such total salaries by credit hours earned by all students, including veterans, in such base period. This rate, determined by the Bureau of Institutional Research, was included in Urbana contracts covering the periods indicated as follows: Rate per Contract Period Credit Hour VA28r ve-142 2/9/46-1/25/47 $9 65 vJX^Sg} V^rvr-i^} I/V47-/7/48 V8/4B-/6/49 V3028V - 751 2/7/49-2/5/50 11 09 These rates result in compensation to the University for about half of the actual instructional costs. The regulations issued by the Veterans Administration referred to allowance for federal funds in such calculations, specifying particularly "Smith-Hughes or other laws" (which provide for reimbursement for expenditures) and state that "due consideration" should be given thereto. There was no indication that funds received under the original Land-Grant Act and supplementary laws would be excluded in arriving at the credit hour rate and hence no allowance for them was made in our calculations. These funds are appropriated to the individual states and in Illinois amount to $160,131 annually. They are expended by the University of Illinois for instructional purposes. In February, 1949, the Business Office was informally advised by a Veterans Administration representative in Washington that no deduction would be made for such funds, but in April, 1949 the Administrator issued decision No. 812 specifically ruling against the inclusion

| |