| |

| |

Caption: Board of Trustees Minutes - 1964

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

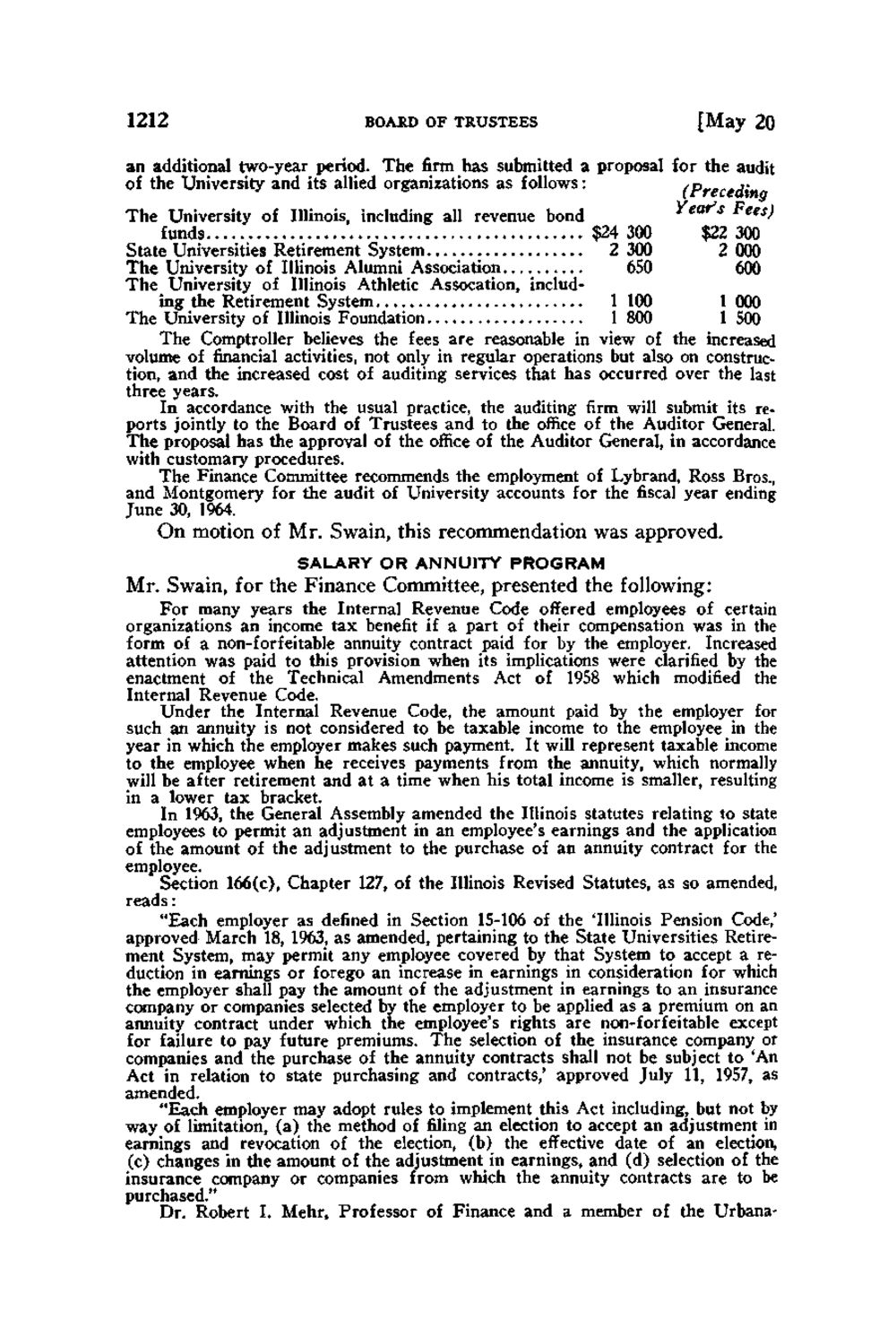

1212 BOARD OF TRUSTEES [May 20 an additional two-year period. The firm has submitted a proposal for the audit of the University and its allied organizations as follows: (Prertdea s t ets The University of Illinois, including all revenue bond ' ) funds $24 300 $22 300 State Universities Retirement System 2 300 2 000 The University of Illinois Alumni Association 650 600 The University of Illinois Athletic Assocation, including the Retirement System 1 100 1 000 The University of Illinois Foundation 1 800 1 500 The Comptroller believes the fees are reasonable in view of the increased volume of financial activities, not only in regular operations but also on construction, and the increased cost of auditing services that has occurred over the last three years. In accordance with the usual practice, the auditing firm will submit its reports jointly to the Board of Trustees and to the office of the Auditor General. The proposal has the approval of the office of the Auditor General, in accordance with customary procedures. The Finance Committee recommends the employment of Lybrand, Ross Bros., and Montgomery for the audit of University accounts for the fiscal year ending June 30, 1964. On motion of Mr. Swain, this recommendation was approved. SALARY OR A N N U I T Y PROGRAM Mr. Swain, for the Finance Committee, presented the following: For many years the Internal Revenue Code offered employees of certain organizations an income tax benefit if a part of their compensation was in the form of a non-forfeitable annuity contract paid for by the employer. Increased attention was paid to this provision when its implications were clarified by the enactment of the Technical Amendments Act of 1958 which modified the Internal Revenue Code. Under the Internal Revenue Code, the amount paid by the employer for such an annuity is not considered to be taxable income to the employee in the year in which the employer makes such payment. It will represent taxable income to the employee when he receives payments from the annuity, which normally will be after retirement and at a time when his total income is smaller, resulting in a lower tax bracket. In 1963, the General Assembly amended the Illinois statutes relating to state employees to permit an adjustment in an employee's earnings and the application of the amount of the adjustment to the purchase of an annuity contract for the employee. Section 166(c), Chapter 127, of the Illinois Revised Statutes, as so amended, reads: "Each employer as defined in Section 15-106 of the 'Illinois Pension Code,' approved March 18, 1963, as amended, pertaining to the State Universities Retirement System, may permit any employee covered by that System to accept a reduction in earnings or forego an increase in earnings in consideration for which the employer shall pay the amount of the adjustment in earnings to an insurance company or companies selected by the employer to be applied as a premium on an annuity contract under which the employee's rights are non-forfeitable except for failure to pay future premiums. The selection of the insurance company or companies and the purchase of the annuity contracts shall not be subject to 'An Act in relation to state purchasing and contracts,' approved July 11, 1957, as amended. "Each employer may adopt rules to implement this Act including, but not by way of limitation, (a) the method of filing an election to accept an adjustment in earnings and revocation of the election, (b) the effective date of an election, (c) changes in the amount of the adjustment in earnings, and (d) selection of the insurance company or companies from which the annuity contracts are to be purchased." Dr. Robert I. Mehr, Professor of Finance and a member of the Urbana-

| |