| |

| |

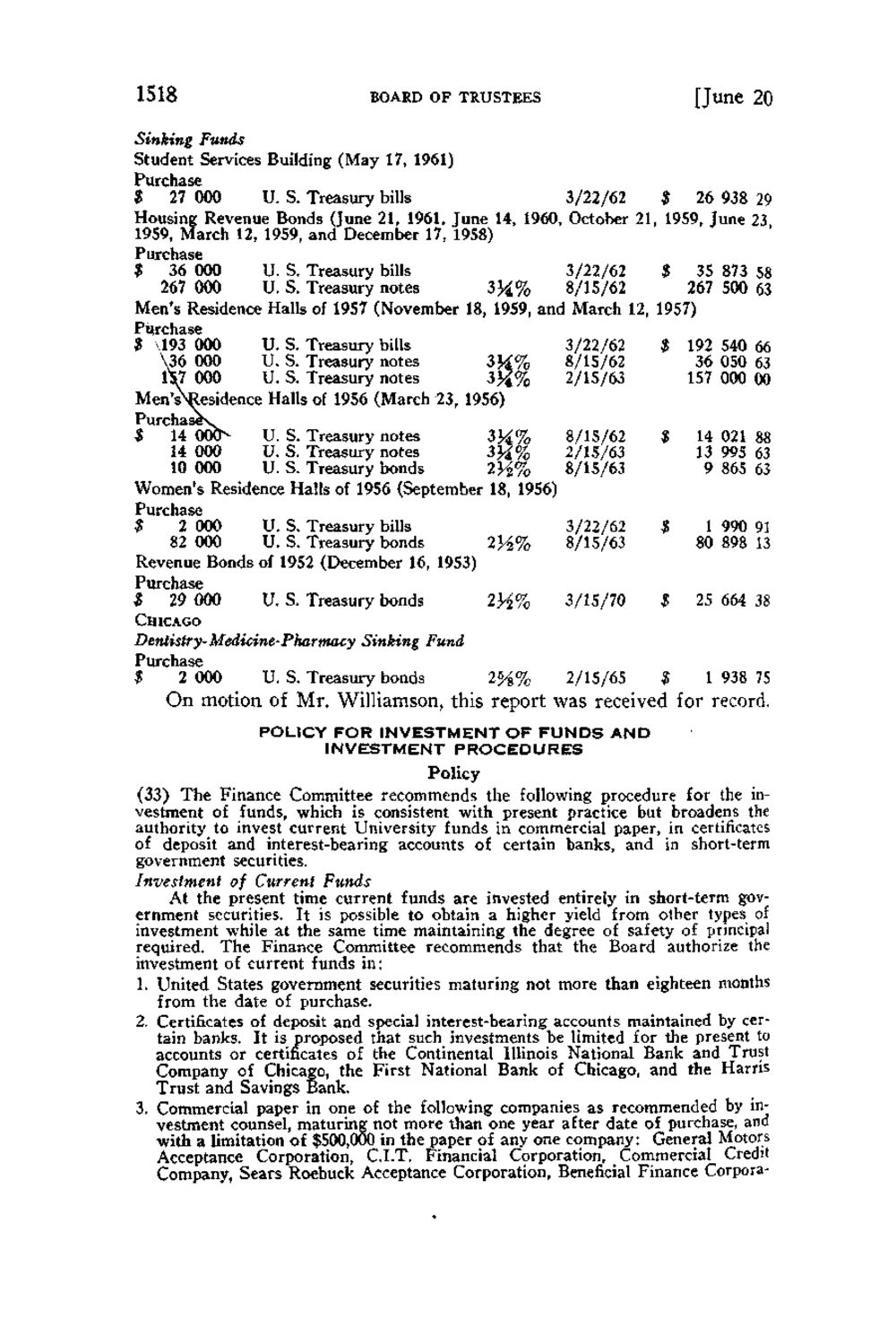

Caption: Board of Trustees Minutes - 1962

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

1518 BOARD OF TRUSTEES [June 20 Sinking Funds Student Services Building (May 17, 1961) Purchase $ 26 938 29 $ 27 000 U. S. Treasury bills 3/22/62 Housing Revenue Bonds (June 21, 1961, June 14, 1960, October 21 1959, June 23, 1959, March 12, 1959, and December 17, 1958) Purchase $ 36 000 U. S. Treasury bills 3/22/62 $ 35 873 58 267 000 U. S. Treasury notes 3J^% 8/15/62 267 500 63 Men's Residence Halls of 1957 (November 18, 1959, and March 12, 1957) Purchase $ ,193 000 U. S. Treasury bills 3/22/62 $ 192 540 66 \36 000 U. S. Treasury notes 3J^% 8/15/62 36 050 63 m 000 U. S. Treasury notes 3%% 2/15/63 157 000 00 Men's\Residence Halls of 1956 (March 23, 1956) Purchaser 8/15/62 $ 14 000sU. S. Treasury notes 3J^% 14 021 88 2/15/63 14 000 U. S. Treasury notes 3K% 13 995 63 8/15/63 10 000 U. S. Treasury bonds 2}|% 9 865 63 Women's Residence Halls of 1956 (September 18, 1956) Purchase $ 2 000 U. S. Treasury bills 3/22/62 1 990 91 82 000 U. S. Treasury bonds 2Y2% 8/15/63 80 898 13 Revenue Bonds of 1952 (December 16, 1953) Purchase 3/15/70 $ 25 664 38 $ 29 000 U. S. Treasury bonds 2)4% CHICAGO Dentistry-Medicine-Pharmacy Sinking Fund Purchase $ 2 000 U. S. Treasury bonds 2%% 2/15/65 $ 1 938 75 On motion of Mr. Williamson, this report was received for record. POLICY FOR INVESTMENT O F F U N D S AND INVESTMENT P R O C E D U R E S Policy (33) T h e Finance Committee recommends the following procedure for the investment of funds, which is consistent with present practice but broadens the authority to invest current University funds in commercial paper, in certificates of deposit and interest-bearing accounts of certain banks, and in short-term government securities. Investment of Current Funds At the present time current funds are invested entirely in short-term government securities. It is possible to obtain a higher yield from other types of investment while at the same time maintaining the degree of safety of principal required. The Finance Committee recommends that the Board authorize the investment of current funds in: 1. United States government securities maturing not more than eighteen months from the date of purchase. 2. Certificates of deposit and special interest-bearing accounts maintained by certain banks. It is proposed that such investments be limited for the present to accounts or certificates of the Continental Illinois National Bank and Trust Company of Chicago, the First National Bank of Chicago, and the Harris Trust and Savings Bank. 3. Commercial paper in one of the following companies as recommended by investment counsel, maturing not more than one year after date of purchase, and with a limitation of $500,000 in the paper of any one company: General Motors Acceptance Corporation, C.I.T. Financial Corporation, Commercial Credit Company, Sears Roebuck Acceptance Corporation, Beneficial Finance Corpora-

| |