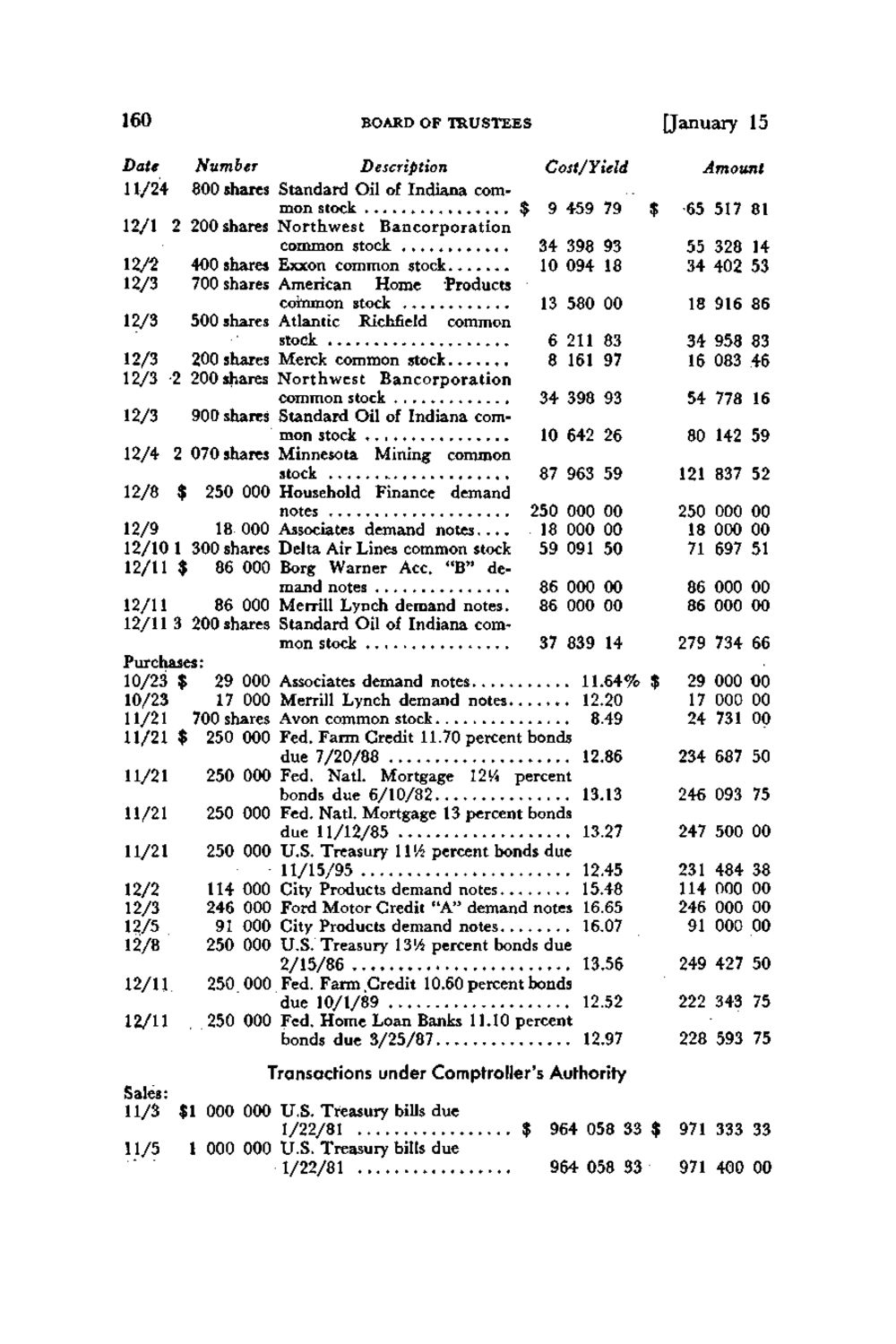

Caption: Board of Trustees Minutes - 1982

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

160 Date 11/24 BOARD OF TRUSTEES (January 15 Amount 65 517 81 55 328 14 34 402 53 18 916 86 34 958 83 16 083 46 54 778 16 80 142 59 1 2 1 8 3 7 52 250 000 00 18 000 00 71 697 51 86 000 00 86 000 00 279 734 66 29 000 00 17 000 00 24 731 00 234 687 50 246 093 75 247 500 00 231484 114 000 246 000 91 000 38 00 00 00 Number Description Cost/Yield 800 shares Standard Oil of Indiana common stock $ 9 459 79 $ 12/1 2 200 shares N o r t h w e s t B a n c o r p o r a t i o n common stock 34 398 93 12/2 400 shares Exxon common stock 10 094 18 12/3 700 shares American Home Products common stock 13 580 00 12/3 500 shares Atlantic Richfield common stock 6 211 83 12/3 200 shares Merck common stock 8 161 97 12/3 2 200 shares N o r t h w e s t B a n c o r p o r a t i o n common stock 34 398 93 12/3 900 shares Standard Oil of Indiana common stock 10 642 26 12/4 2 070 shares Minnesota Mining common stock 87 963 59 12/8 $ 250 000 Household Finance demand notes 250 000 00 12/9 18 000 Associates demand notes 18 000 00 12/10 1 300 shares Delta Air Lines common stock 59 091 50 12/11 $ 86 000 Borg Warner Ace. " B " demand notes 86 000 00 12/11 86 000 Merrill Lynch demand notes. 86 000 00 12/11 3 200 shares Standard Oil of Indiana common stock 37 839 14 Purchases: 10/23 $ 29 000 Associates demand notes 11.64% $ 10/23 17 000 Merrill Lynch demand notes 12.20 11/21 700 shares Avon common stock 8.49 1 1 / 2 1 $ 250 000 Fed. Farm Credit 11.70 percent bonds due 7/20/88 12.86 11/21 250 000 Fed. Natl. Mortgage 12W percent bonds due 6/10/82 13.13 11/21 250 000 Fed. Natl. Mortgage 13 percent bonds due 11/12/85 13.27 11/21 250 000 U.S. Treasury 1IV2 percent bonds due 11/15/95 12.45 12/2 114 000 City Products demand notes 15.48 12/3 246 000 Ford Motor Credit "A" demand notes 16.65 12/5 91 000 City Products demand notes 16.07 12/8 250 000 U.S. Treasury 13V4 percent bonds due 2/15/86 13.56 12/11 250 000 Fed. Farm Credit 10.60 percent bonds due 10/1/89 12.52 12/11 250 000 Fed. Home Loan Banks 11.10 percent bonds due 3/25/87 12.97 Transactions u n d e r Comptroller's Authority Sales: 11/3 $1 000 000 U.S. Treasury bills due 1/22/81 $ 964 058 3 3 $ 11/5 1 000 000 U.S. Treasury bills due 1/22/81 964 058 33 249 427 50 222 343 75 228 593 75 9 7 1 3 3 3 33 9 7 1 4 0 0 00

|