| |

| |

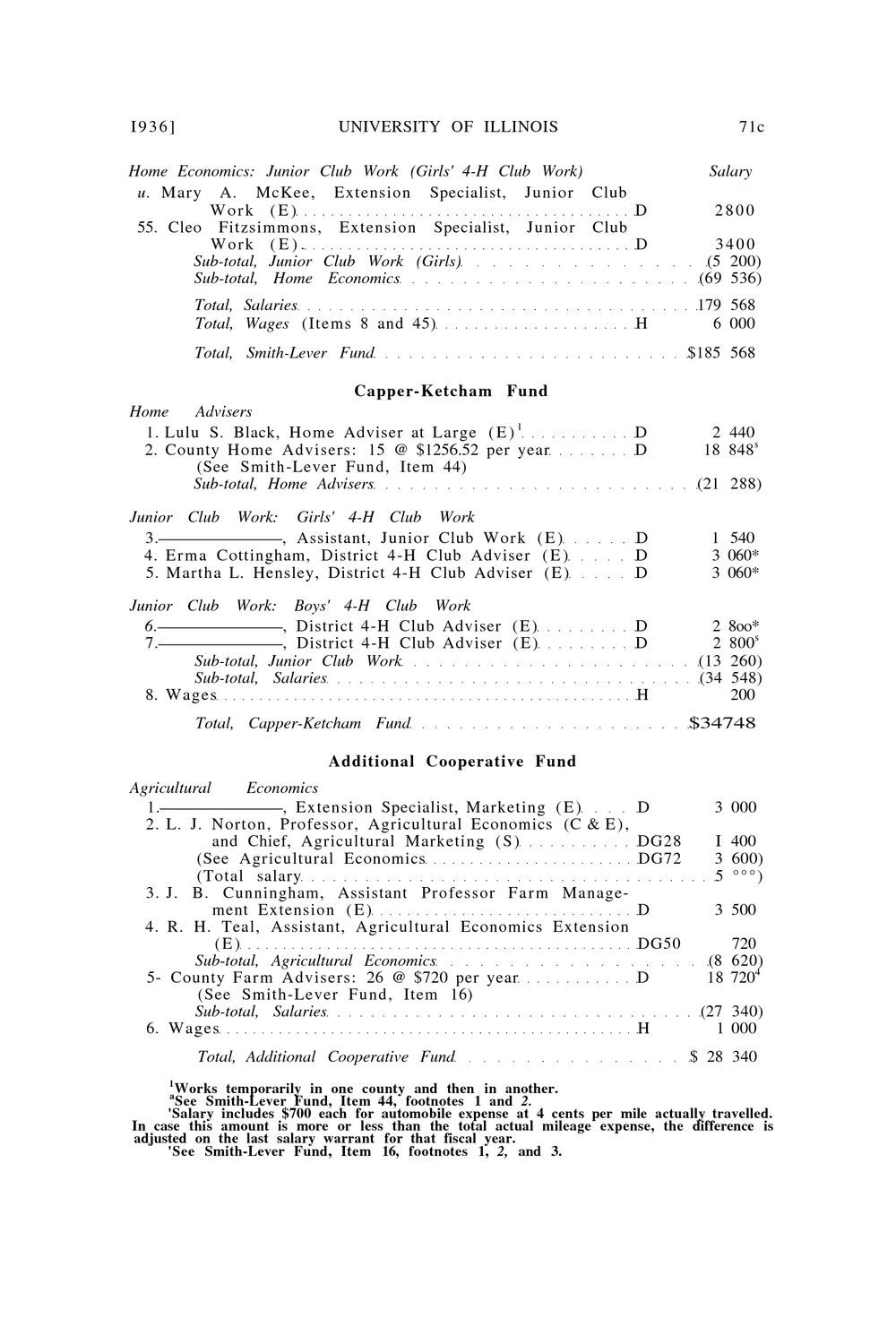

Caption: Board of Trustees Minutes - 1936

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

I936] UNIVERSITY OF ILLINOIS 71c Salary 2800 3400 (5 200) (69 536) 179 568 6 000 $185 568 Home Economics: Junior Club Work (Girls' 4-H Club Work) u. Mary A. McKee, Extension Specialist, Junior Club Work ( E ) D 55. Cleo Fitzsimmons, Extension Specialist, Junior Club Work ( E ) . D Sub-total, Junior Club Work (Girls) Sub-total, Home Economics Total, Salaries Total, Wages (Items 8 and 45) Total, Smith-Lever Fund Capper-Ketcham Fund Home Advisers 1. Lulu S. Black, H o m e Adviser at Large ( E ) 1 2. County Home Advisers: 15 @ $1256.52 per year (See Smith-Lever Fund, Item 44) Sub-total, Home Advisers Junior Club Work: Girls' 4-H Club Work 3. , Assistant, Junior Club Work ( E ) 4. E r m a Cottingham, District 4-H Club Adviser ( E ) 5. Martha L. Hensley, District 4-H Club Adviser ( E ) Junior Club Work: Boys' 4-H Club Work 6. , District 4-H Club Adviser ( E ) 7. , District 4-H Club Adviser ( E ) Sub-total, Junior Club Work Sub-total, Salaries 8. Wages Total, Capper-Ketcham Fund Additional Cooperative Fund Agricultural Economics 1. , Extension Specialist, Marketing ( E ) 2. L. J. Norton, Professor, Agricultural Economics (C & E ) , and Chief, Agricultural Marketing ( S ) (See Agricultural Economics (Total salary 3. J. B. Cunningham, Assistant Professor F a r m Management Extension ( E ) 4. R. H. Teal, Assistant, Agricultural Economics Extension (E) Sub-total, Agricultural Economics 5- County F a r m Advisers: 26 @ $720 per year (See Smith-Lever Fund, Item 16) Sub-total, Salaries 6. Wages Total, Additional Cooperative Fund 1 Works a H D D 2 440 18 848s (21 288) D D D D D H 1 540 3 060* 3 060* 2 2 (13 (34 8oo* 800s 260) 548) 200 $34748 D DG28 DG72 D DG50 D H 3 000 I 400 3 600) 5 °°°) 3 500 720 (8 620) 18 7204 (27 340) 1 000 $ 28 340 temporarily in one county and then in another. See Smith-Lever Fund, Item 44, footnotes 1 and 2. 'Salary includes $700 each for automobile expense at 4 cents per mile actually travelled. In case this amount is more or less than the total actual mileage expense, the difference is adjusted on the last salary warrant for that fiscal year. 'See Smith-Lever Fund, Item 16, footnotes 1, 2, and 3.

| |