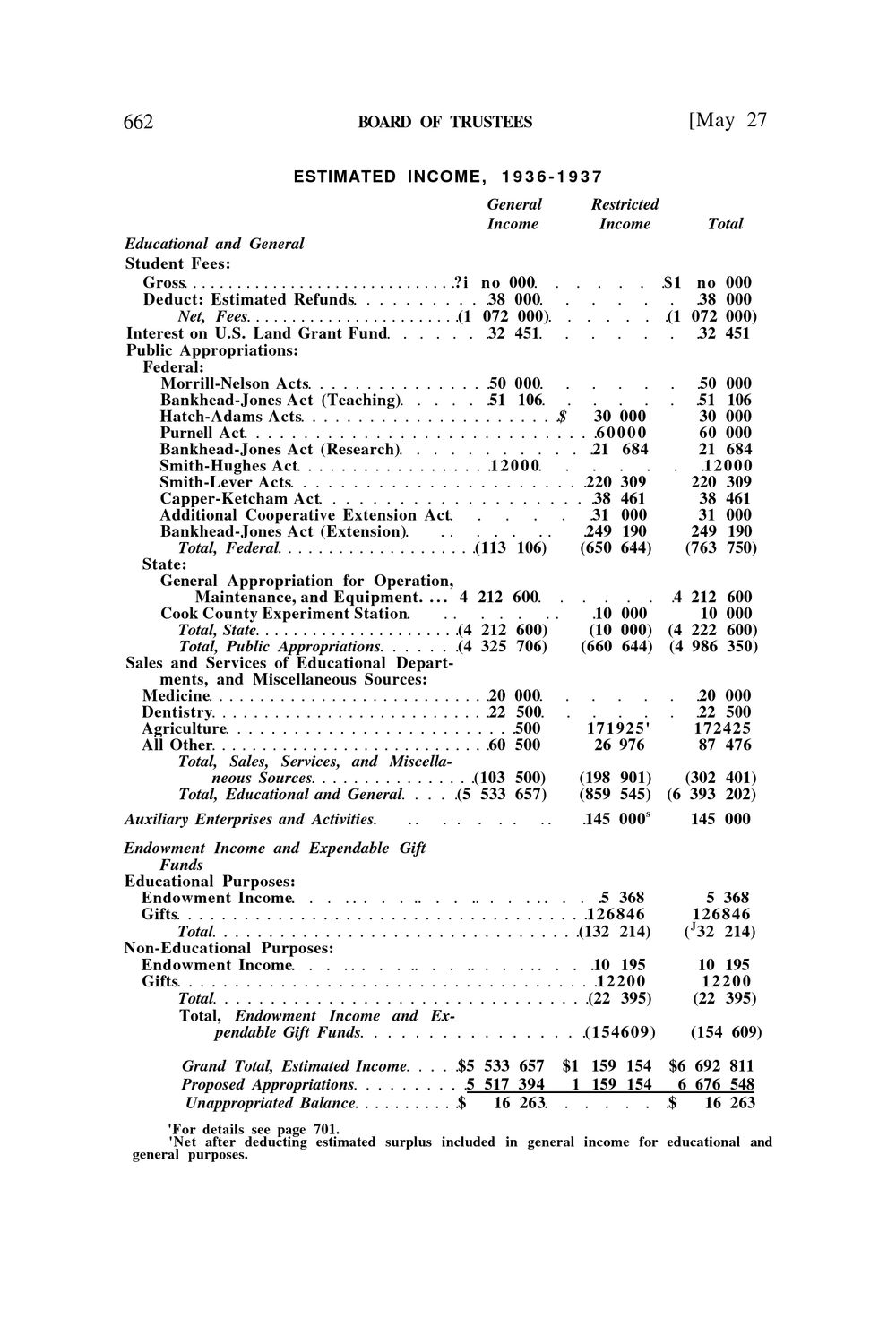

Caption: Board of Trustees Minutes - 1936

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

662 BOARD OF TRUSTEES ESTIMATED INCOME, 1 9 3 6 - 1 9 3 7 General Income Restricted Income [May 27 Total Educational and General Student Fees: Gross ?i no 000 Deduct: Estimated Refunds 38 000 Net, Fees (1 072 000) Interest on U.S. Land Grant Fund 32 451 Public Appropriations: Federal: Morrill-Nelson Acts 50 000 Bankhead-Jones Act (Teaching) 51 106 Hatch-Adams Acts $ 30 000 Purnell Act 60000 Bankhead-Jones Act (Research) 21 684 Smith-Hughes Act 12000 Smith-Lever Acts 220 309 Capper-Ketcham Act 38 461 Additional Cooperative Extension Act 31 000 Bankhead-Jones Act (Extension) 249 190 Total, Federal (113 106) (650 644) State: General Appropriation for Operation, Maintenance, and Equipment. . . . 4 212 600 Cook County Experiment Station 10 000 Total, State (4 212 600) (10 000) Total, Public Appropriations (4 325 706) (660 644) Sales and Services of Educational Departments, and Miscellaneous Sources: Medicine 20 000 Dentistry 22 500 Agriculture 500 171925' All Other 60 500 26 976 Total, Sales, Services, and Miscellaneous Sources (103 500) (198 901) Total, Educational and General (5 533 657) (859 545) Auxiliary Enterprises and Activities 145 000 s Endowment Income and Expendable Gift Funds Educational Purposes: Endowment Income Gifts Total Non-Educational Purposes: Endowment Income Gifts Total Total, Endowment Income and Expendable Gift Funds Grand Total, Estimated Income Proposed Appropriations Unappropriated Balance $5 533 657 5 517 394 $ 16 263 $1 no 38 (1 072 32 000 000 000) 451 50 000 51 106 30 000 60 000 21 684 12000 220 309 38 461 31 000 249 190 (763 750) 4 212 10 (4 222 (4 986 600 000 600) 350) 20 000 22 500 172425 87 476 (302 401) (6 393 202) 145 000 5 368 126846 (132 214) 10 195 12200 (22 395) (154609) $1 159 154 1 159 154 5 368 126846 ( J 32 214) 10 195 12200 (22 395) (154 609) $6 692 811 6 676 548 $ 16 263 'For details see page 701. 'Net after deducting estimated surplus included in general income for educational and general purposes.

|