| |

| |

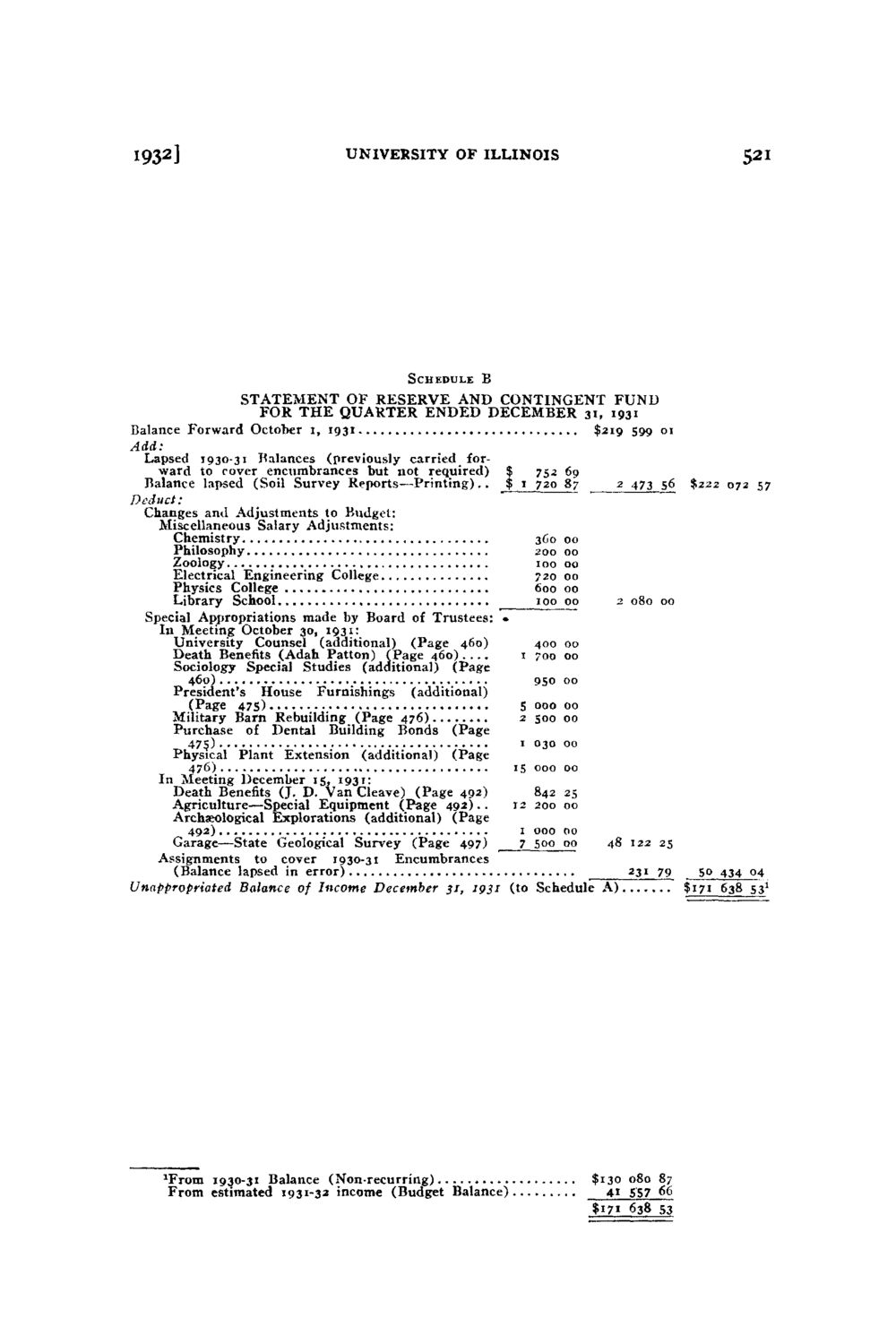

Caption: Board of Trustees Minutes - 1932

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

i932J UNIVERSITY OF ILLINOIS 521 Schedule B STATEMENT OF RESERVE AND CONTINGENT FUND FOR T H E QUARTER ENDED DECEMBER 31, 1931 Balance Forward October 1, 1931 „ , $219 599 01 Add: Lapsed 1930-31 Balances (previously carried forward to cover encumbrances but not required) $ 752 69 Balance lapsed (Soil Survey Reports—Printing).. $ 1 720 87 2 473 56 $222 072 57 Deduct: Changes and Adjustments to Budget: Miscellaneous Salary Adjustments: Chemistry 3G0 00 Philosophy 200 00 Zoology 100 00 Electrical Engineering College 720 00 Physics College . 600 00 Library School 100 00 2 080 00 Special Appropriations made by Board of Trustees: • In Meeting October 30, 1931: University Counsel (additional) (Page 460) 400 00 Death Benefits (Adah Patton) (Page 460).... 1 700 00 Sociology Special Studies (additional) (Page 460) 950 00 President's House Furnishings (additional) (Page 475) *•• 5 000 00 Military Barn Rebuilding (Page 476) 2 500 00 Purchase of Dental Building Bonds (Page 475) 1 030 00 Physical Plant Extension (additional) (Page 476) 15 000 00 In Meeting December 15, 1931: Death Benefits (J. D. Van Cleave) (Page 492) 842 25 Agriculture—Special Equipment (Page 49*) • • i2 200 00 Archaeological Explorations (additional) (Page 492) 1 000 00 Garage—State Geological Survey (Page 497) 7 500 00 48 ^22 25 Assignments to cover 1930-31 Encumbrances (Balance lapsed in error) 231 79 50 434 04 Unappropriated Balance of Income December 31, 1931 (to Schedule$130 080 87 $171 638 531 A) 1From 1930-31 Balance (Non-recurring) From estimated 1931-32 income (Budget Balance) 41 557 66 $171 638 53

| |