| |

| |

Caption: Board of Trustees Minutes - 1932

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

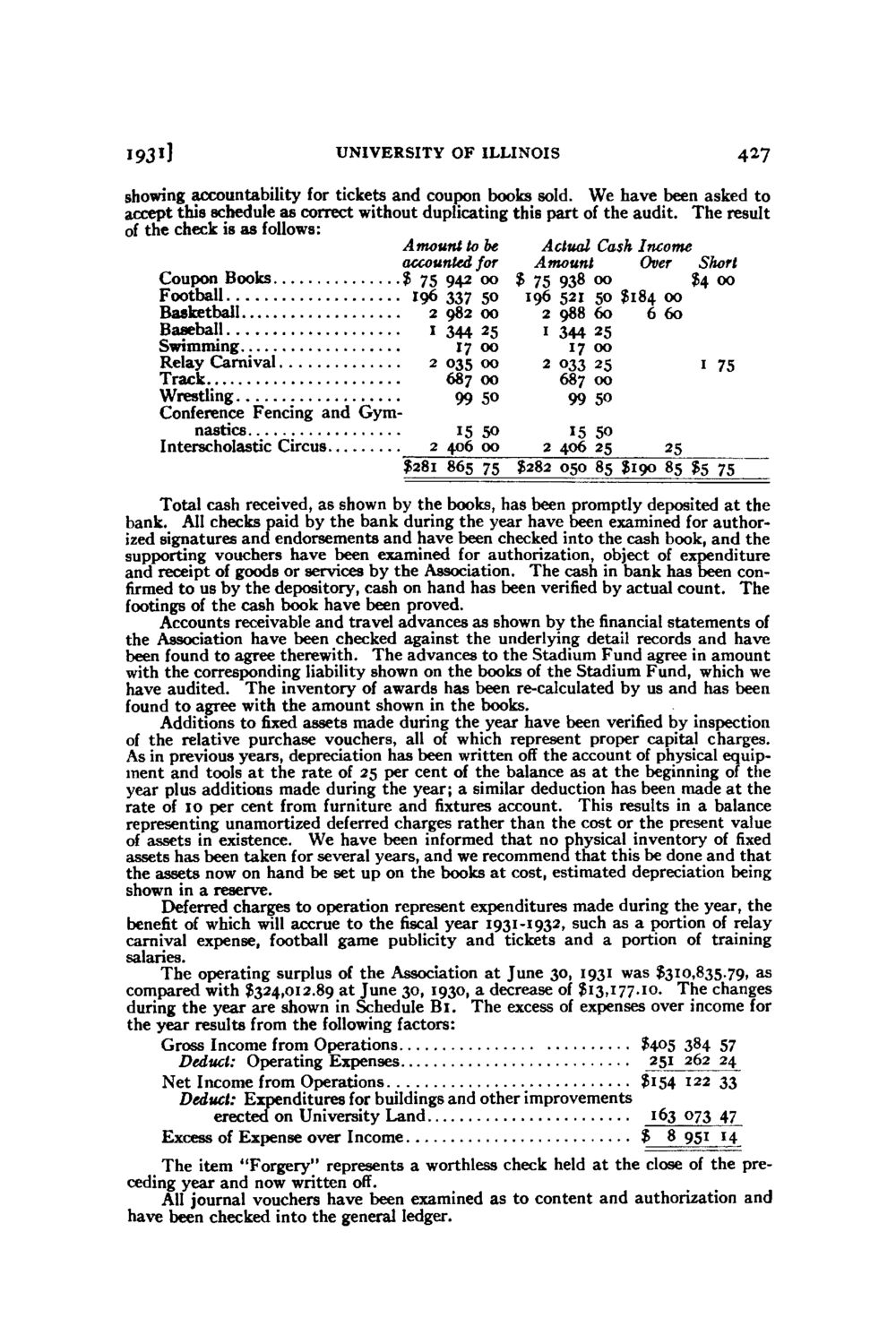

1931] U N I V E R S I T Y O F ILLINOIS 427 showing accountability for tickets and coupon books sold. We have been asked to accept this schedule as correct without duplicating this part of the audit. The result of the check is as follows: Amount to be Actual Cash Income accounted for Amount Over Short Coupon Books $ 75 942 00 $ 75 938 00 $4 00 Football 196 337 50 196 521 50 $184 00 Basketball 298200 298860 660 Baseball 1 344 25 1 344 25 Swimming 17 00 17 00 Relay Carnival 2 035 00 2 033 25 1 75 Track 687 00 687 00 Wrestling 99 50 99 50 Conference Fencing and G y m nastics 15 50 15 50 Interscholastic Circus 2 406 00 2 406 25 25 $281 865 75 $282 050 85 $190 85 $5 75 Total cash received, as shown by the books, has been promptly deposited at the bank. A H checks paid by the bank during the year have been examined for authorized signatures and endorsements and have been checked into the cash book, and the supporting vouchers have been examined for authorization, object of expenditure and receipt of goods or services by the Association. The cash in bank has been confirmed to us by the depository, cash on hand has been verified by actual count. The footings of the cash book have been proved. Accounts receivable and travel advances as shown by the financial statements of the Association have been checked against the underlying detail records and have been found to agree therewith. The advances to the Stadium Fund agree in amount with the corresponding liability shown on the books of the Stadium Fund, which we have audited. The inventory of awards has been re-calculated by us and has been found to agree with the amount shown in the books. Additions tofixedassets made during the year have been verified by inspection of the relative purchase vouchers, all of which represent proper capital charges. As in previous years, depreciation has been written off the account of physical equipment and tools at the rate of 25 per cent of the balance as at the beginning of the year plus additions made during the year; a similar deduction has been made at the rate of 10 per cent from furniture and fixtures account. This results in a balance representing unamortized deferred charges rather than the cost or the present value of assets in existence. W e have been informed that no physical inventory of fixed assets has been taken for several years, and we recommend that this be done and that the assets now on hand be set up on the books at cost, estimated depreciation being shown in a reserve. Deferred charges to operation represent expenditures made during the year, the benefit of which will accrue to thefiscalyear 1931-1932, such as a portion of relay carnival expense, football game publicity and tickets and a portion of training salaries. The operating surplus of the Association at June 30, 1931 was $310,835.79, as compared with $324,012.89 at June 30, 1930, a decrease of $13,177.10. The changes during the year are shown in Schedule Bl. The excess of expenses over income for the year results from the following factors: Gross Income from Operations $405 384 57 Deduct: Operating Expenses 251 262 24 Net Income from Operations $'54 I22 33 Deduct: Expenditures for buildings and other improvements erected on University Land 163 073 47 Excess of Expense over Income $ 8 951 14 The item "Forgery" represents a ledger. ceding year and vouchers have beenworthless as to content and authorization and haveAll journal now written off. been checked into the general examined check held at the close of the pre-

| |