| |

| |

Caption: Board of Trustees Minutes - 1932

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

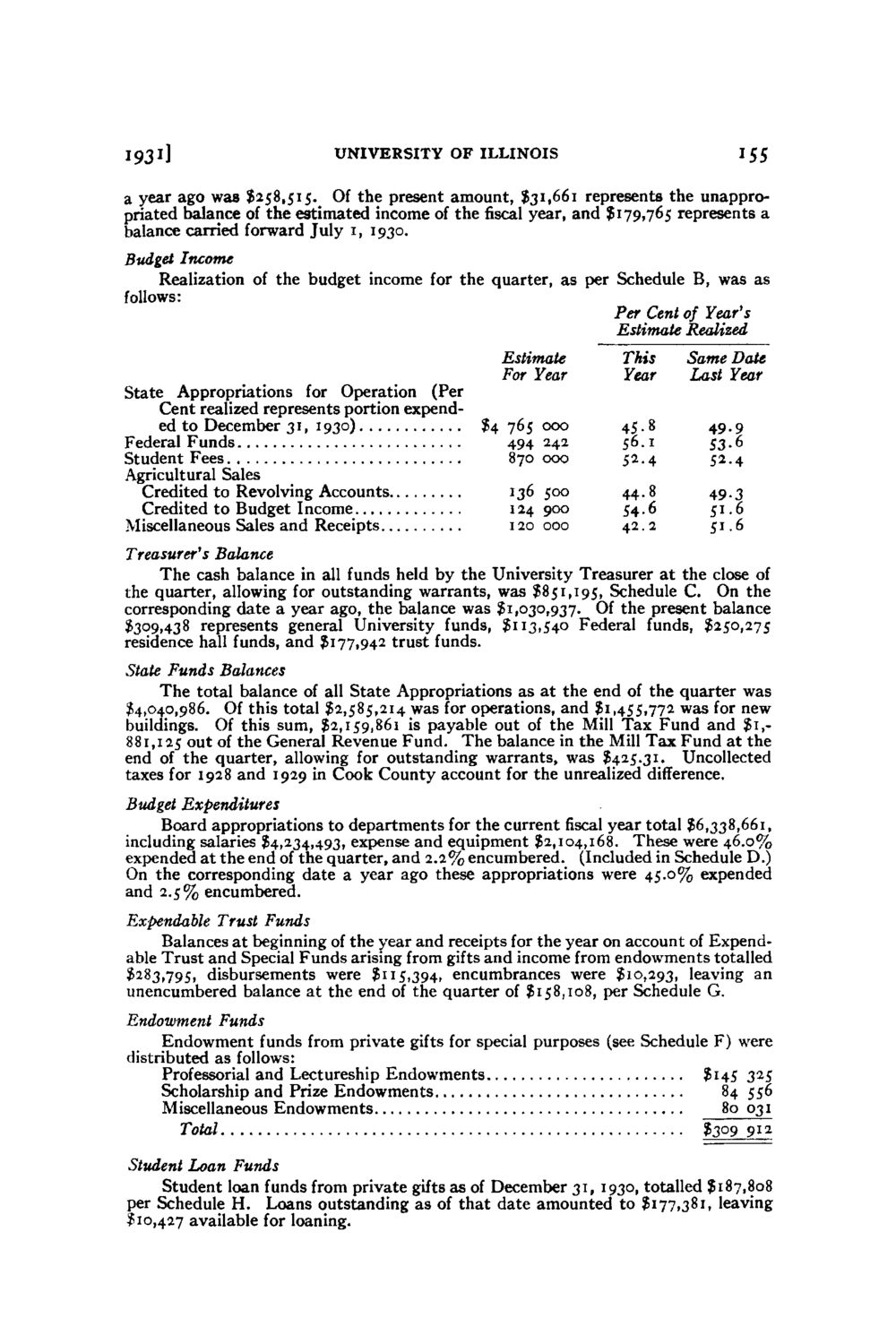

i93i] U N I V E R S I T Y O F ILLINOIS 155 a year ago was $258,515. Of the present amount, $31,661 represents the unappropriated balance of the estimated income of thefiscalyear, and $179,765 represents a balance carried forward July 1, 1930. Budget Income Realization of the budget income for the quarter, as per Schedule B, was as follows: Per Cent of Year's Estimate Realized Estimate This Same Date For Year Year Last Year State Appropriations for Operation (Per Cent realized represents portion expended to December 31, 1930) $4 765 000 45.8 49.9 Federal Funds 494 242 56.1 53.6 Student Fees 870 000 52.4 52.4 Agricultural Sales Credited to Revolving Accounts 136 500 44.8 49.3 Credited to Budget Income 124 900 54.6 51.6 Miscellaneous Sales and Receipts 120000 42,2 51.6 Treasurer's Balance The cash balance in all funds held by the University Treasurer at the close of the quarter, allowing for outstanding warrants, was $851,195, Schedule C. O n the corresponding date a year ago, the balance was $1,030,937. Of the present balance $309,438 represents general University funds, $113,540 Federal funds, $250,275 residence hall funds, and $177,942 trust funds. State Funds Balances The total balance of all State Appropriations as at the end of the quarter was $4,040,986. Of this total $2,585,214 was for operations, and $1,455,772 was for new buildings. Of this sum, $2,159,861 is payable out of the Mill Tax Fund and $1,881,125 °ut of the General Revenue Fund. The balance in the Mill Tax Fund at the end of the quarter, allowing for outstanding warrants, was $425.31. Uncollected taxes for 1928 and 1929 in Cook County account for the unrealized difference. Budget Expenditures Board appropriations to departments for the current fiscal year total $6,338,661, including salaries $4,234,493, expense and equipment $2,104,168. These were 46.0% expended at the end of the quarter, and 2.2% encumbered. (Included in Schedule D.) O n the corresponding date a year ago these appropriations were 45.0% expended and 2.5% encumbered. Expendable Trust Funds Balances at beginning of the year and receipts for the year on account of Expendable Trust and Special Funds arising from gifts and income from endowments totalled $283,795, disbursements were $115,394, encumbrances were $10,293, leaving an unencumbered balance at the end of the quarter of $158,108, per Schedule G. Endowment Funds Endowment funds from private gifts for special purposes (see Schedule F) were distributed as follows: Professorial and Lectureship Endowments $145 325 Scholarship and Prize Endowments 84 556 Miscellaneous Endowments 80 031 Total $309 912 Student Loan Funds Student loan funds from private gifts as of December 31, 1930, totalled $187,808 per Schedule H. Loans outstanding as of that date amounted to $177,381, leaving $10,427 available for loaning.

| |