| |

| |

Caption: War Publications - WWI Compilation 1923 - Article 6

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

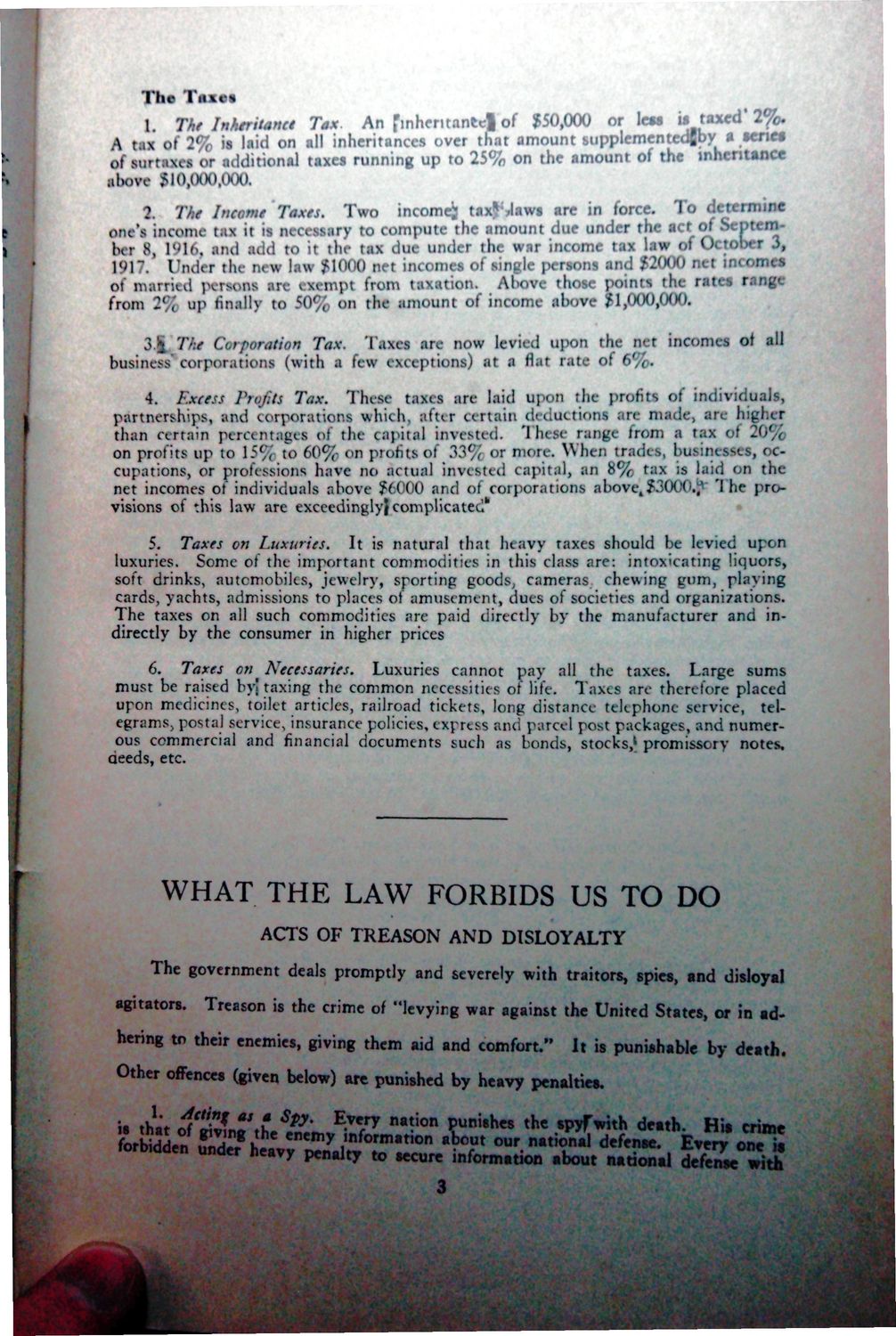

1 he Taxes I. The Inheritance Tax. An finhentantclof $50,000 or 1CM iitaxed' 1% ix of 2% is laid on all inheritances over that amount supplementcd|by a aenet irtaxes or additional taxes running up to 25% on the amount of the inheritance ,- 5IO,(kHm,R). lie Income Taxes. Two incomejf tax&^aws are in force. To determine one's income tax it is necess;irv to compute tne amoun lur S, 1916, and add to it the tax due under the wai income I'M 7. Vinler the new law Jinno net incomes of single persons and $2<*1Q net inc mes of married persons are exempt from taxation. Above those Doinis the rates t nge from 2Vc up finally to 509c »« the amount of income above /1,'KH),(KK). 3.£ The Corporation Tax. Taxes are now levied upon the net incomes of all business corporations (with a few exceptions) at a Hat rata of 6%. 4. Excess Profits Tax. These taxes are laid up«-n the profits of individuals, partnerships, and corporations which, after certain deductions are made, are higher than certain percentages of the capital invested. These range from a tax of 2(/., on profits up to 15V, to 60% on profits of 3 3 % or more. When trades, businesses, occupations, or professions have no actual invested capital, an 8% tax is laid on the net incomes of individuals above $6000 and of corporations above4J3000.J*" 'I he provisions of this law are exceedingly} complicated* • 5. Taxes on Luxuries. It is natural that heavy taxes should be levied upon luxuries. Some of the important commodities in this class are: intoxicating liquors, soft drinks, automobiles, jewelry, sporting goods, cameras chewing gum, playing cards, yachts, admissions to places of amusement, dues of societies and organizations. The taxes on all such commodities are paid directly by the manufacturer and indirectly by the consumer in higher prices 6. Taxes on Necessaries. Luxuries cannot pay all the taxes. Large sums must be raised by! taxing the common necessities of life. Taxes are therefore placed upon medicines, toilet articles, railroad tickets, long distance telephone service, telegrams, postal service, insurance policies, express and parcel post packages, and numer1 ous commercial and financial documents such as bonds, stocks, promissory notes, deeds, etc. WHAT THE LAW FORBIDS US TO DO ACTS OF TREASON AND DISLOYALTY The government deals promptly and severely with traitors, spies, and disloyal agitators. Treason is the crime of "levying war against the United States, or in adhering to their enemies, giving them aid and comfort." It is punishable by death. Other offences (given below) are punished by heavy penalties. is that o f d v f n ? \ L ' ^V ! ? 'PyTwith death. Hit era crime is Muucr ncavy penalty to secure informatmn about **• »;*>«•. defense * secure information aKn.,* national j-r- ' . Spy 7 na ion uni8hes the I

| |