| |

| |

Caption: Board of Trustees Minutes - 1944

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

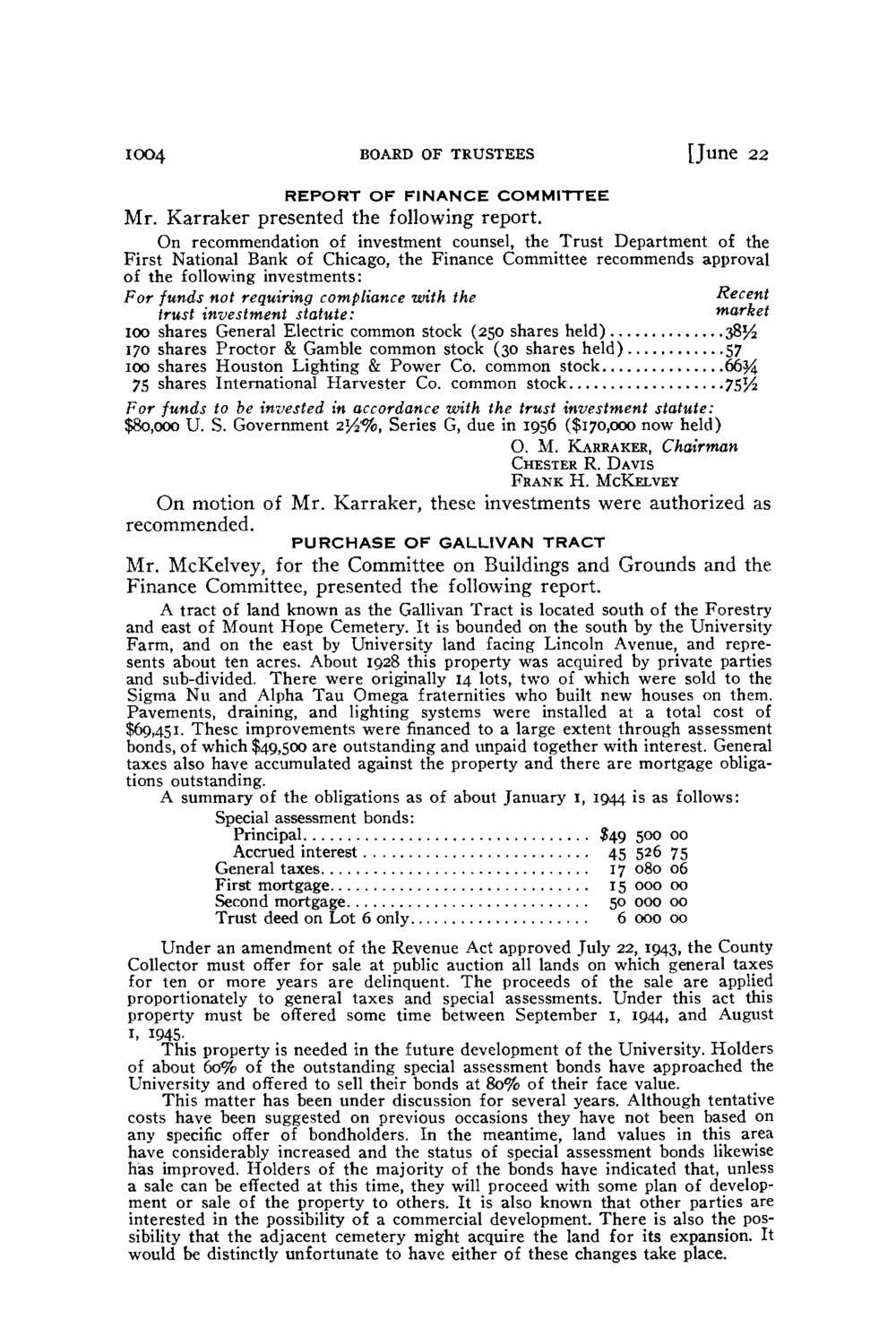

ioo4 BOARD OF TRUSTEES [June 22 REPORT OF FINANCE COMMITTEE M r . K a r r a k e r presented the following report. On recommendation of investment counsel, the T r u s t Department of the First National Bank of Chicago, the Finance Committee recommends approval of the following investments: For funds not requiring compliance with the Recent trust investment statute: market ioo shares General Electric common stock (250 shares held) 38^ 170 shares Proctor & Gamble common stock (30 shares held) 57 100 shares Houston Lighting & Power Co. common stock 6654 75 shares International Harvester Co. common stock 75^ For funds to be invested in accordance with the trust investment statute: $80,000 U. S. Government 21/2'%, Series G, due in 1956 ($170,000 now held) O. M. KARRAKER, Chairman CHESTER R. D A V I S F R A N K H . MCKELVEY O n m o t i o n of M r . K a r r a k e r , t h e s e i n v e s t m e n t s w e r e a u t h o r i z e d a s recommended. PURCHASE OF GALL1VAN TRACT Mr. McKelvey, for the Committee on Buildings and Grounds and the Finance Committee, presented the following report. A tract of land known as the Gallivan Tract is located south of the Forestry and east of Mount Hope Cemetery. It is bounded on the south by the University Farm, and on the east by University land facing Lincoln Avenue, and represents about ten acres. About 1928 this property was acquired by private parties and sub-divided. There were originally 14 lots, two of which were sold to the Sigma N u and Alpha T a u Omega fraternities who built new houses on them. Pavements, draining, and lighting systems were installed at a total cost of $69,451. These improvements were financed to a large extent through assessment bonds, of which $49,500 are outstanding and unpaid together with interest. General taxes also have accumulated against the property and there are mortgage obligations outstanding. A summary of the obligations as of about January I, 1944 is as follows: Special assessment bonds: Principal S49 500 00 Accrued interest 45 526 75 General taxes 17 080 06 First mortgage 15 000 00 Second mortgage 50 000 00 Trust deed on Lot 6 only 6 000 00 Under an amendment of the Revenue Act approved July 22, 1943, the County Collector must offer for sale at public auction all lands on which general taxes for ten or more years are delinquent. T h e proceeds of the sale are applied proportionately to general taxes and special assessments. Under this act this property must be offered some time between September 1, 1944, and August This property is needed in the future development of the University. Holders of about 60% of the outstanding special assessment bonds have approached the University and offered to sell their bonds at 80% of their face value. This matter has been under discussion for several years. Although tentative costs have been suggested on previous occasions they have not been based on any specific offer of bondholders. In the meantime, land values in this area have considerably increased and the status of special assessment bonds likewise has improved. Holders of the majority of the bonds have indicated that, unless a sale can be effected at this time, they will proceed with some plan of development or sale of the property to others. It is also known that other parties are interested in the possibility of a commercial development. T h e r e is also the possibility that the adjacent cemetery might acquire the land for its expansion. It would be distinctly unfortunate to have either of these changes take place.

| |