| |

| |

Caption: Book - Housing Bond Issue of 1952

This is a reduced-resolution page image for fast online browsing.

EXTRACTED TEXT FROM PAGE:

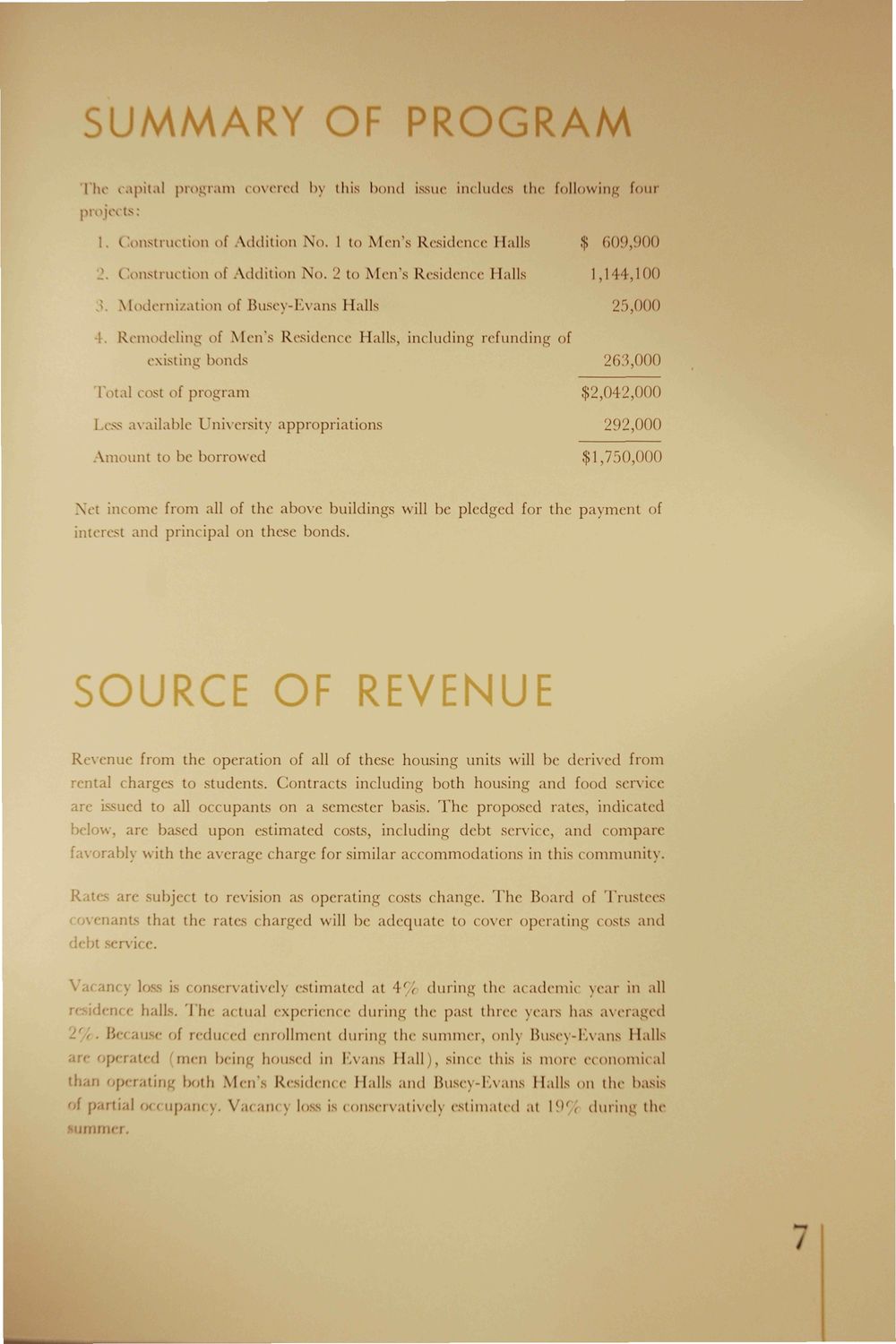

SUMMARY OF PROGRAM I he capital program covered by this bond issue includes the following four projects: 1. Construction of Addition No. 1 to Men's Residence Halls 2, Construction of Addition No. 2 to Men's Residence Halls 3, Modernization of Busey-Evans Halls 4. Remodeling of Men's Residence Halls, including refunding of existing bonds Total cost of program Less available University appropriations Amount to be borrowed 263,000 $2,042,000 292,000 $1,750,000 $ 609,900 1,144,100 25,000 Net income from all of the above buildings will be pledged for the payment of interest and principal on these bonds. SOURCE OF REVENUE Revenue from the operation of all of these housing units will be derived from rental charges to students. Contracts including both housing and food service arc issued to all occupants on a semester basis. The proposed rates, indicated below, are based upon estimated costs, including debt service, and compare fav< tbly with the average charge for similar accommodations in this community. are subject to revision as operating costs change. The Board of Trustees 'Hants that the rates charged will be adequate to cover operating costs and debt servi< e. Vacancy lo i conservatively estimated at -\' < during the academic year in all dence halls. The actual experience during the past three years has averaged Because of reduced enrollment during the summer, only Busey-Evans Halls operated men being housed in Evans Hall), since this is more economical than operating both Men's Residence Halls and Buse\ -Kvans Halls on the basis <)f f partial occupancy. Vacanc) loss is < onscrvatively estimated at 1 . during the juimcr. Rat

| |